S&P/ASX 300 Index (ASX: XKO) stock Rural Funds Group (ASX: RFF) has been named as an appealing opportunity.

Rural Funds is a real estate investment trust (REIT) that owns different types of farmland including cattle, almonds, macadamias, vineyards and cropping (sugar and cotton).

The broker Moelis has called Rural Funds a buy with its initial coverage of the ASX 300 stock, according to reporting by the Australian Financial Review.

Positive rating on Rural Funds shares

Moelis thinks Rural Funds is attractive because it's trading at a 29% discount to its net asset value (NAV) and it's yielding 5.7%, making it a "highly compelling investment opportunity", according to Moelis analyst Edward Day.

The analyst thinks earnings growth for the ASX 300 share will be driven by improved operations and capital deployed into The Rohatyn Group lease. Though, weak macadamia prices are supposedly negative for earnings.

The AFR quoted Day's comments on the business:

Key catalysts include the divestment of assets to ensure RFF's capital position remains strong, valuation uplift on capex programs, and a recovery in the profitability of assets operated on balance sheet.

Main metrics of the ASX 300 stock

Rural Funds has provided guidance for the 2024 financial year.

It has forecast adjusted funds from operations (AFFO) – meaning the rental profit – could be 11.2 cents per unit. That would put the current Rural Funds share price at more than 18 times FY24's estimated rental profit.

The ASX 300 stock is expecting to pay a cash distribution of 11.73 cents per unit again, which translates into the forward distribution yield of 5.7% that Moelis referred to.

It'll be interesting to see what happens with the adjusted NAV in FY24 considering it rose by 8.9% to $2.93 per unit in FY23 thanks to positive revaluations for all of the segments, including a 14% rise in the macadamia division.

While the interest rate is higher, Rural Funds is experiencing solid revenue growth thanks to a mixture of built-in rental indexation at farms (CPI and fixed rental increases), as well as developments at farms.

Rural Funds share price snapshot

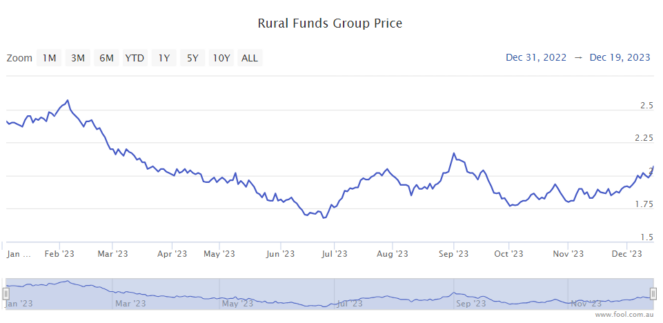

The Rural Funds share price has fallen more than 10% since the start of the year, despite the recent recovery, as we can see on the chart below.