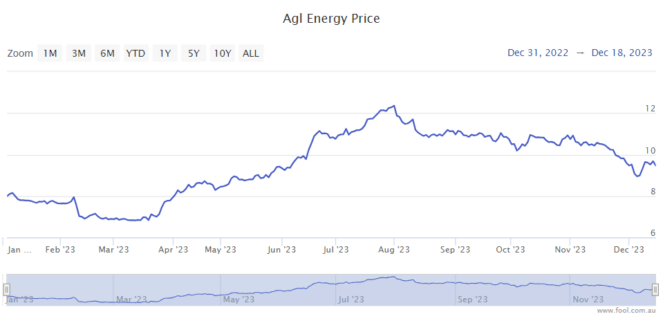

The AGL Energy Ltd (ASX: AGL) share price has been drifting lower since the start of August – it's down 25%. But shares are still up 13% for 2023. Can 2024 be much better for the ASX energy share?

Several months ago, the business was benefiting from an environment where wholesale prices were stronger.

But things have changed quite a lot.

Weaker wholesale prices

Energy retailers like AGL generally lock in the retail price for the financial year ahead, so a change in wholesale prices takes a while to flow through to prices paid by households and businesses.

Wholesale prices have been weakening. It wasn't long ago that the Australian Financial Review noted two reports from the Australian Energy Regulator (AER) and the Australian Energy Market Operator, which revealed wholesale power prices had fallen as much as 70% year over year. That's not helpful for AGL shares, though may help household bills in the future.

The AFR reported on comments from St Vincent de Paul Society manager of policy and research, Gavin Dufty, who said:

I believe households and small businesses are unlikely to see anything until possibly the start of the next financial year.

The way retailers contract in the wholesale market is on long-term contracts, which means our prices are locked in until these contracts are renegotiated.

Furthermore, retailers tend to reprice their portfolios at the start of each financial year to reflect changes in the underlying cost of poles and wires, which are reset at this time by the AER.

However, reporting by the AFR suggested a hot summer may increase wholesale prices again because of how that might increase demand for air conditioning.

So, while AGL has seen wholesale prices decrease, stronger demand this summer may send prices higher again. Either way, FY24 energy prices seem largely decided already.

The company is expecting a significant increase in underlying profitability in FY24. Underlying earnings before interest, tax, depreciation and amortisation (EBITDA) is expected to grow to between $1.875 billion to $2.175 billion, while underlying net profit after tax (NPAT) could grow to between $580 million to $780 million.

Ultimately profit growth is what investors like to see in order to send the AGL share price, but FY25 and FY26 are less certain.

Profit estimates

The broker UBS' current estimate for net profit is $675 million in FY24, $756 million in FY25 and $790 million in FY26. But, I suspect those further-away estimates may be subject to change as time goes on, and possibly lower.

Those numbers put the current AGL share price at 9x FY24's estimated earnings, 8x FY25's estimated earnings and 8x FY26's estimated earnings. They don't seem like demanding numbers, but that's only if the projected profit is achieved. Time will tell whether the market thinks today's valuation is too cheap or if it's about to go lower.