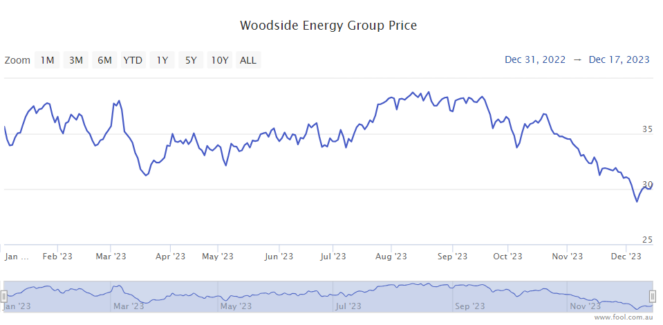

The Woodside Energy Group Ltd (ASX: WDS) share price has been going in the wrong direction in the last few months, as we can see on the chart below. Can the ASX energy share turn things around in 2024?

Earnings and regulator difficulties

Woodside is expected to see a significant earnings decline in 2024 compared to 2022.

The broker UBS has forecast revenue will be US$14.6 billion in 2024, compared to US$16.6 billion in 2022.

Net profit after tax (NPAT) is expected to be US$2.24 billion in 2024, down from US$5.24 billion in 2022.

UBS said recently it was cautious about growing risks to the Scarborough and Pluto 2 schedule and, therefore, the capital expenditure. The broker added that "pressure on regulatory approvals could stifle further equity sell-downs/LNG sales from Scarborough."

UBS pointed out the successful appeal at Scarborough a few months ago by a traditional custodian of Woodside's regulatory approval to conduct seismic surveying at Scarborough over the quarter was another example of the "heightened pressure on regulatory approvals for hydrocarbon developments."

Greenpeace is the latest organisation to take Woodside to court over alleged greenwashing.

In what might be another headwind, investors often value blue-chip companies based on how much profit they're expected to make. If this is the case, it's understandable to see the Woodside share price dropping.

Based on the current Woodside share price and the current exchange rate, it's valued at 12x FY24's forecast earnings, according to UBS. Whatever happens next with energy prices could have a significant influence, but that seems very unpredictable.

It could also pay a grossed-up dividend yield of 9.6% following the heavy decline.

Despite the challenges, UBS currently has a price target of A$35.40 on the ASX energy share, which suggests a possible rise of 16% over the next year. That's a prediction, however, and price targets can change.

Santos Ltd (ASX: STO) merger?

There was speculation and recent confirmation that Woodside and Santos are in early talks about a possible merger.

If they did combine, the business would become a major player on the global scene.

It's not guaranteed to go ahead for various reasons – Woodside shareholders may decide to vote against a tie-up if they don't think they're getting a good deal.

However, greater scale could come with some benefits, including stronger margins

Woodside share price snapshot

Interestingly, at $30.58, the Woodside share price is almost exactly where it was five years ago.