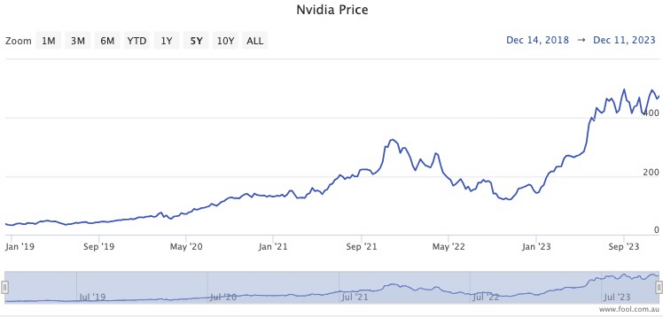

How big a smile would you have on your face if you had the foresight to own Nvidia Corp (NASDAQ: NVDA) shares at the start of this year?

The stock for the computer chip maker has soared more than 225% in 2023, and there's still 18 days left to boost that gain.

The incredible run has been triggered by how the business has been able to cash in on the artificial intelligence craze.

Although Nvidia doesn't create AI itself, it makes the "picks and shovels" that other companies need to execute the computation-hungry technology.

Its chips are so sought after the US government has banned the export of Nvidia's most advanced models to China, out of fear that they could be used for nefarious purposes.

However, Nvidia is no startup. It's been making investors wealthy over decades.

Even if you analyse the most recent five years, the Nvidia share price has gone from US$8.12 on 11 December 2015 to US$466.27 on Tuesday morning.

Those shrewd enough to have the stock in their portfolio over that time now have in their hot hands a 57-bagger.

Incredible.

So what about for the rest of us who missed out on that journey?

There are some contenders on the ASX in earlier stages of their life cycle that are capable of such future growth.

Last week we took a look at physical retailer Lovisa Holdings Ltd (ASX: LOV).

This time let's check out an e-commerce platform that has caught the imagination of ASX investors in recent times:

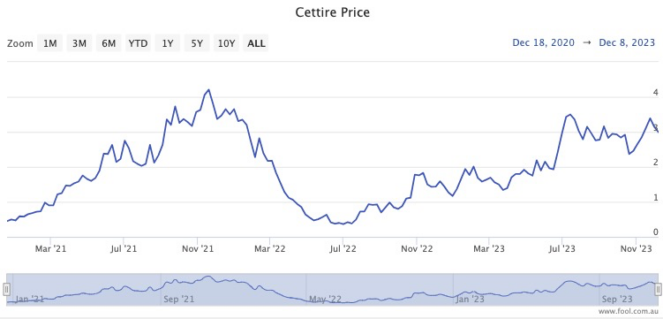

7-bagger in 18 months

Cettire Ltd (ASX: CTT) is an online platform that sells luxury fashion items directly to consumers.

Its first three years of listed life has been an absolute rollercoaster.

The stock sold for 50 cents at its initial public offering (IPO) and on its first day on the ASX on 18 December 2020 it immediately plunged 10%.

But investors soon warmed to the marketplace business model that didn't require Cettire to hold any inventory.

By November 2021, the share price reached as high as $4.32, returning a spectacular 764% to those still holding stocks from the IPO.

Then, of course, inflation and interest rate fears struck the stock market and growth shares were sold off en masse.

In just seven months the Cettire share price plummeted more than 90%.

But in the 18 months since that trough, Cettire has stood back up on the canvas and knocked out its doubters.

If you can believe it, the e-commerce stock has gained more than 627% since June last year.

But what will Cettire shares do from here on?

So you can see the explosive potential of this stock.

But can it keep it up in the long run to rack up Nvidia-like performance over eight years?

Of course, no one holds a crystal ball.

But check out this analysis of Cettire from the experts at Bell Potter.

"Cettire has a rapidly growing global online luxury personal goods retailing platform in a large market with a structural shift to online well underway," read its investor note this month.

"We believe Cettire will continue to outperform its peer group consisting of global luxury retailers and local e-commerce players given its <1% market share in a growing market, which could remain more resilient than other discretionary categories in a likely recessionary environment."

Those analysts have a share price target of $4, which is another 44% upside in just 12 months.

That would go a long way to becoming a double-digit-bagger over the next decade.

The $1 billion company is still sparsely covered by professional investors. According to CMC Invest, two of three analysts believe Cettire shares are a buy, while the third one rates them as a hold.