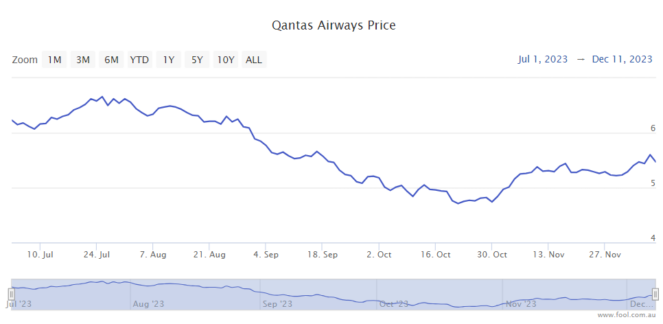

The Qantas Airways Limited (ASX: QAN) share price has dropped more than 15% since July 2023. The ASX travel share has been hit hard by a number of issues including regulator and legal problems, the prospect of having to replace an ageing fleet and uncertainty about future profitability.

As we can see on the chart above, Qantas shares have bounced off a low – up more than 16% from the bottom in October.

Is it possible that the Qantas share price can reach $6 by Christmas? It's certainly possible, though it could also go back to $5. Christmas is only two weeks away, it's impossible to know what's going to happen in such a short amount of time.

Hence, it's better to focus on whether the valuation today is cheap and the outlook for the company from here.

Is the Qantas share price cheap?

It's certainly cheaper than it was earlier this year.

Some industries do trade on a lower price/earnings (P/E) ratio than others.

Airlines take a lot of capital to operate, the balance sheet requirements aren't necessarily seen straight away by the valuation. Many profitable tech companies don't have much in terms of capital requirements (including to fund the growth), that's partly why they usually trade on a higher P/E ratio.

The broker UBS suggests Qantas could generate earnings per share (EPS) of 96 cents in both FY24 and FY25, which would imply the company is valued at under 6 times FY24's and FY25's estimated earnings.

For most businesses, that is a low P/E ratio, particularly for one that is expected to keep seeing profit growth. UBS forecasts EPS could rise to 97 cents in FY26, $1.05 in FY27 and $1.18 in FY28. Higher profit could help the Qantas share price.

Of course, these are just educated guesses at this stage – forecasts can change, conditions can change, and estimates can be wrong.

A few months ago, Qantas looked as though it was facing higher fuel costs, but thankfully the oil price has reduced. UBS points out the airline is spending on initiatives like additional seats available for points redemption, improved catering, improved call centre support and more generous policies to help customers through service disruptions.

Half of the $80 million that Qantas is spending in FY24 is recurring in nature, though the financial impact of some policies may be offset by better reliability.

Outlook for the ASX travel share

UBS believes Qantas can adjust settings, whether that's with capacity and/or fares prices if the fuel expense becomes too much.

The broker suggested that while domestic fare prices remained high, international fares were starting to decline. But, the airline did say that demand in the three months to September was similar to the three months to June 2023.

While there are still unknowns about how the ACCC attention is going to play out, UBS thinks if Qantas can hit its FY24 margin targets, prove its resilience, and resolve concerns it could lead to a "re-rating".

UBS has a buy rating on the airline with a price target of $7.70 which includes its expectations of the future costs of decarbonisation. It helps that the business continues to enact its share buyback.

The broker's price target of $7.70 suggests a possible rise of 40% over the next 12 months. This is just a guess and not a suggestion of what might happen over the next two weeks. But UBS seems to believe the airline can rise to a much higher level than $6 in the next 12 months.