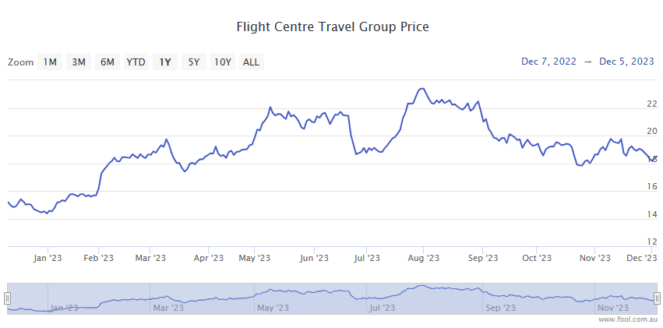

Despite sliding 1.4% today and 21% since 31 July, Flight Centre Travel Group Ltd (ASX: FLT) shares remain up a heady 28% year to date.

For some context, the S&P/ASX 200 Index (ASX: XJO) is up a more modest 3% so far this year.

2023 also saw Flight Centre shares deliver the first dividend payout since 2019 when COVID-19 grounded most all domestic and international travel. Although only 18 cents per share, the return of dividends is a bullish sign in my book.

Yet the ASX 200 travel stock remains amongst the most shorted stock on the ASX.

This week, ASIC data indicates 9.3% of Flight Centre shares are held short, with investors concerned that sticky inflation and high-interest rates could dent the resurgence in travel demand.

So, do the short sellers have this right? Or can Flight Centre continue to reward investors in 2024?

Will Flight Centre shares soar or sink in 2024?

Despite the conviction of short sellers, I believe Flight Centre shares are more likely to post significant gains in 2024 than ongoing losses.

Following on its solid FY 2023 growth results, the ASX 200 travel stock recently reported some strong metrics for the first quarter of FY 2024.

Among the highlights, total transaction volume (TTV) increased 20% from Q1 FY 2023 to $6 billion. That's the second-best Q1 performance in the company's history.

Underlying profits before tax of $54 million were up 500% from the prior corresponding period, while earnings before interest, taxes, depreciation, and amortisation (EBITDA) increased 200% to $102 million.

And Flight Centre shares could lift off in 2024 if the company meets its FY 2024 guidance.

Management is forecasting underlying profit before tax in the range of $270 million to $310 million. That compares to underlying profit before tax of $106 million in FY 2023.

And EBITDA is forecast to come in the range of $460 million to $500 million, up from $302 million in FY 2023.

With those growth prospects in mind, 2024 could be another profitable year for Flight Centre shareholders.

What are the experts saying?

Goldman Sachs has a neutral rating on the ASX 200 travel stock with a $20 12-month price target, representing a potential 8.5% upside from current levels.

According to the broker (courtesy of CommSec):

We view FLT's recovery as a sum of two tales: 1/ Corporate segment is expected to lead recovery with ongoing account wins including organic and competitive budget and offers encouraging long-term outlook, but 2/ We expect leisure recovery to be below pre-pandemic levels and the channel strategy to be revenue margin dilutive.

Overall, we view FLT's valuation as fully reflective of growth prospects. We do not see any short-term balance sheet risks.

UBS also has a neutral rating on Flight Centre shares, with a 12-month price target of $23.45, representing a potential 27% upside from today's price.

And Morgans counts amongst the most bullish of the experts, with an 'add rating' and a $26 12-month price target, representing a potential 41% upside in 2024 from today's levels.

"With confidence that the travel recovery has much further to go and the benefits of FLT's transformed business model emerging, we think the company is well placed over coming years," the broker said.