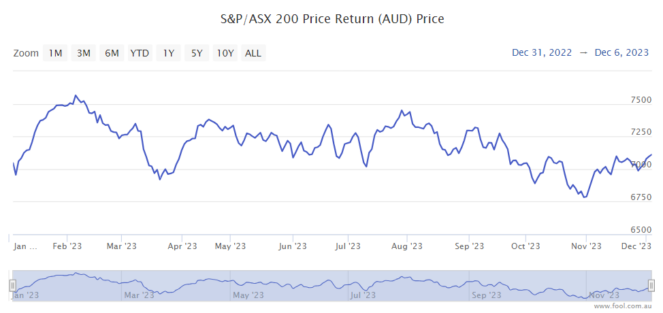

The S&P/ASX 200 Index (ASX: XJO) has seen plenty of ups and downs this year. In this article, I'm going to share my predictions for 2024.

I wouldn't base my whole investment philosophy on how I thought the ASX share market was going to go over 12 months, which is a relatively short time period. But, it's interesting, and fun, to think about.

Looking back at my predictions from last year, I suggested the ASX 200 could finish higher (it's currently up 2%), big dividends would keep flowing from ASX bank shares and a few other names (the payouts have kept flowing), and I suggested that ASX tech shares could be among the top performers. In 2023 to date, the Altium Limited (ASX: ALU) share price is up 31%, the REA Group Limited (ASX: REA) share price is up 45% and the Xero Limited (ASX: XRO) share price is up 46%.

It may have been a bit of luck that the ASX 200 and ASX tech shares have recovered some (or all) of the lost ground from 2022, though the tech valuations looked attractive to me a year ago.

Volatility is unpredictable, but it happens so often that we should expect it. In fact, it's odd if there isn't volatility.

So, for a bit of fun, these are my thoughts on what could happen next year with the ASX 200:

Australian interest rates to keep lagging

The Reserve Bank of Australia (RBA) was slower to start increasing the interest rate compared to other central banks and it didn't go as high – for example the Bank of England base interest rate is 5.25%.

The RBA rate has jumped higher to 4.35%, but it may have been too slow to quell the high rate of inflation at a fast enough speed.

Australia now reportedly has the highest inflation rate among the world's largest advanced economies. There is still some work to do to bring Australia's inflation to 3%.

The RBA recently increased interest rates (in November) and I think it could take a while for it to start cutting. Why do interest rates (and market projections on rates) matter? Warren Buffett once said about interest rates:

The value of every business, the value of a farm, the value of an apartment house, the value of any economic asset, is 100% sensitive to interest rates because all you are doing in investing is transferring some money to somebody now in exchange for what you expect the stream of money to be, to come in over a period of time, and the higher interest rates are the less that present value is going to be. So every business by its nature…its intrinsic valuation is 100% sensitive to interest rates.

Whatever the RBA does with interest rates could have a sizeable impact on the ASX 200.

FY24 financials to be tricky

I wouldn't be surprised to see profit go backwards for a number of ASX 200 shares this financial year, particularly many of the retailers.

Banks are facing the potential for higher bad debts/provisions because of the higher interest rate environment, and the net interest margin (NIM) is being squeezed.

Many retailers are facing a weaker consumer environment, with lower sales and higher costs.

Real estate investment trusts (REITs) and other businesses with high debt face increasing costs due to the higher interest rates.

Some resource prices have dropped, such as lithium and copper, which could be profitable in FY24.

Share prices won't necessarily move down when a profit decline is reported – the market is probably already expecting that.

Stock pickers' market

I think there will be plenty of opportunities for investors to find individual ASX shares that have been treated too harshly.

The lower down the market capitalisation we go, the more I think it's possible to find opportunities that could perform strongly in 2024 (and beyond). I'm going to mention a few ASX 200 shares in a moment, but the ASX small-cap share part of the market looks particularly interesting to me.

In the last month or so, I've invested in names like Lovisa Holdings Ltd (ASX: LOV), Johns Lyng Group Ltd (ASX: JLG) and Pinnacle Investment Management Group Ltd (ASX: PNI) that I think could do well.

My prediction here is plenty of the smaller businesses will outperform the bigger ASX blue-chip shares. I'm going to keep my eyes peeled and investment dollars ready.