The S&P/ASX 200 Index (ASX: XJO) Metcash Ltd (ASX: MTS) share price fell this week to a 52-week low. In this article, I'm going to talk about why I rate the company as a buy.

Metcash is an interesting business – it supplies IGA and Foodland supermarkets around the country. It also supplies independent liquor stores in Australia including IGA Liquor, Bottle-O, Cellarbrations, Porters Liquor, Thirsty Camel and Duncans.

It also has a growing hardware division with the brands Mitre 10, Home Timber & Hardware, Total Tools and it supports Thrifty-Link Hardware and True Value Hardware operators.

Here are three key reasons why I think it's a good buy today.

Better Metcash share price valuation

Metcash is the type of blue-chip business I expect to be around for many years to come, so being able to buy it at a cheaper price is attractive to me during short-term market fears.

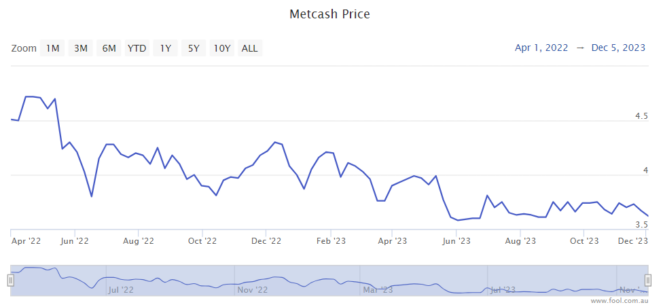

Since April 2022, the Metcash share price has dropped 27% and it is down close to 20% in the past year.

If we look at the UBS estimate for Metcash in FY24, it's suggested the earnings per share (EPS) could be 28 cents, which would put the forward price/earnings (P/E) ratio at 12.5 times.

I think it looks like a cheap ASX 200 share, particularly when compared to somewhat similar names like Wesfarmers Ltd (ASX: WES) and Woolworths Group Ltd (ASX: WOW).

UBS has forecast that profit can steadily improve between FY25 to FY28, which would be a tailwind for the Metcash share price and possibly the dividend.

Ongoing revenue growth

The company recently reported its FY24 result which showed 1.3% revenue growth and a 12.2% rise in statutory net profit after tax (NPAT), though underlying NPAT fell 10.9% because of higher costs.

I was pleased to see that revenue continues to grow. In the first four weeks of the second half of FY24, total sales went up 0.8%.

For me, most importantly in the early part of the second half, total hardware sales were up 2.4% and Total Tools sales went up 6.2%.

Revenue (growth) normally has a key influence on the profit, so it's a longer-term positive to see revenue climbing. It's pleasing to see the company saying there is higher foot traffic at IGA stores.

I think this ASX 200 share can be one of the beneficiaries of Australia's growing population, with more mouths to feed and more homes needed to be built.

Great dividend

Metcash has a fairly low P/E ratio and typically has quite a generous dividend payout ratio, resulting in a pleasing dividend yield, which can mean decent cash returns regardless of what the Metcash share price is doing amid volatility.

In the FY24 half-year result, it declared an interim dividend per share of 11 cents. Another payout of 11 cents in six months would mean a grossed-up dividend yield of 8.9%.

UBS has a more conservative projection of 20 cents per share for FY24, which would be a grossed-up dividend yield of 8.1%.

Foolish takeaway

Metcash is one of my favourites when it comes to high-yield ASX dividend shares. I'm optimistic about the long-term, particularly with the hardware earnings.