We made it! It's finally the last month of what has felt like a long-haul 2023. Now, it's beginning to look a lot like Christmas.

As investors, we know that even in tough economic times when the stock market is volatile, it's still possible to earn passive income. A great way to achieve this is by investing in quality shares that pay dividends.

So, if you want some gifts that should keep on giving into the New Year and beyond, you've come to the right place. We asked our Motley Fool writers to name the top ASX dividend shares they reckon may be worth 'stocking' up on this December. Here is what the team came up with:

5 best ASX dividend shares for December 2023 (smallest to largest)

- BetaShares Australian Dividend Harvester Fund (ASX: HVST), $183.74 million

- Accent Group Ltd (ASX: AX1) $1.04 billion

- Pinnacle Investment Management Group Ltd (ASX: PNI), $1.81 billion

- Harvey Norman Holdings Limited (ASX: HVN), $4.71 billion

- Telstra Group Ltd (ASX: TLS), $43.79 billion

(Market capitalisations as of market close 1 December 2023).

Why our Foolish writers love these ASX passive income stocks

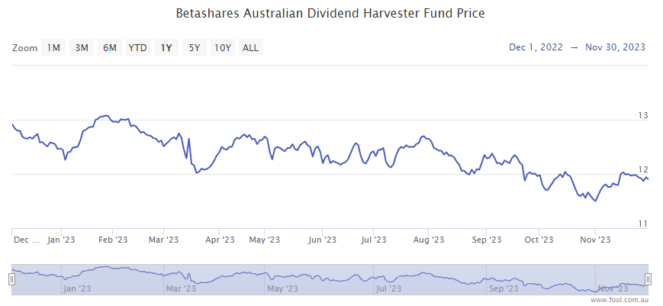

BetaShares Australian Dividend Harvester Fund

What it does: HVST is an exchange-traded fund (ETF) that provides investors with exposure to a diversified portfolio of ASX dividend shares. Currently, its top three holdings are BHP Group Ltd (ASX: BHP), National Australia Bank Ltd (ASX: NAB) and CSL Limited (ASX: CSL).

By Bernd Struben: I think the BetaShares Australian Dividend Harvester Fund is a great way for investors to own a diversified passive income portfolio with a single investment. HVST holds between 40 and 60 high-yielding, blue-chip ASX dividend stocks.

Every quarter or so, the fund's managers rebalance the portfolio to give shareholders reweighted exposure to ASX stocks paying dividends during the ensuing quarter. And the ETF pays out dividends (currently franked at 77%) on a monthly basis.

As at 31 October, the 12-month yield comes out to 7.4%. The 12-month grossed-up yield, which includes franking credits, equates to 9.9%.

Management costs are 0.72% annually. The HVST share price is down 2% year to date.

Motley Fool contributor Bernd Struben does not own shares of the BetaShares Australian Dividend Harvester Fund.

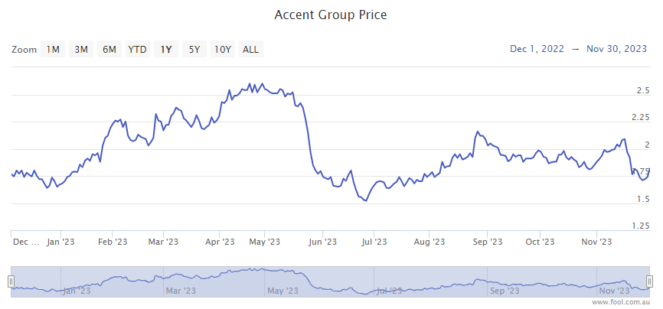

Accent Group Ltd

What it does: Accent is the footwear-focused retailer behind retail brands such as The Athlete's Foot, HypeDC, Platypus, and Style Runner.

By James Mickleboro: I'm picking Accent Group for the second month in a row. That's because I believe a spot of weakness in November has created a compelling buying opportunity for income investors in December.

Accent Group's shares came under pressure after the company revealed that inflationary pressures were weighing on costs during the first half. While this is disappointing, with inflation now easing, I believe this is a short-term issue that will be quickly rectified.

Bell Potter expects this to be the case and is forecasting a return to strong earnings growth in FY 2025. In light of this, it is forecasting fully franked dividends per share of 11.1 cents in FY 2024 and then 13 cents in FY 2025. This equates to yields of 6.1% and 7.2%, respectively.

Bell Potter has a buy rating and $2.35 price target on its shares.

Motley Fool contributor James Mickleboro does not own shares of Accent Group Ltd.

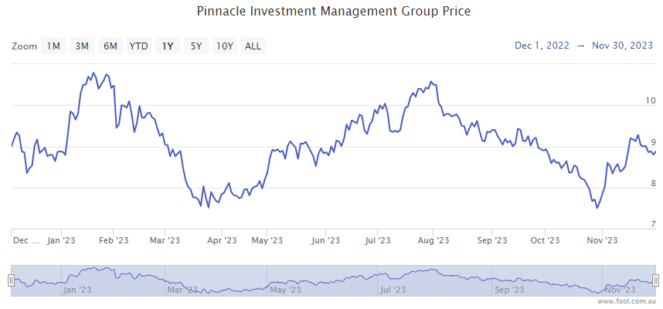

Pinnacle Investment Management Group Ltd

What it does: Pinnacle is an S&P/ASX 200 Index (ASX: XJO) financial share that helps high-performing fund managers set up their own funds management businesses. Pinnacle can provide services like seed funding, distribution and client services, fund administration, compliance, finance, legal, technology and more so the fund managers can focus on investing.

By Tristan Harrison: The Pinnacle share price is down more than 50% from November 2021, making it a better value today. It's invested in a number of high-quality fund managers (affiliates) that have a track record of delivering long-term outperformance and growing funds under management (FUM).

The company can grow in a number of different ways, including new affiliates, new strategies within affiliates, new distribution channels and new geographies.

In the six months to 30 June 2023, Pinnacle saw aggregate net inflows of $3.1 billion, showing a recovery of investor sentiment and potential positivity for FY24. FUM growth and more outperformance could be a strong combination for longer-term earnings growth if that occurs.

It has a trailing grossed-up dividend yield of 5.8%.

Motley Fool contributor Tristan Harrison owns shares of Pinnacle Investment Management Group Ltd.

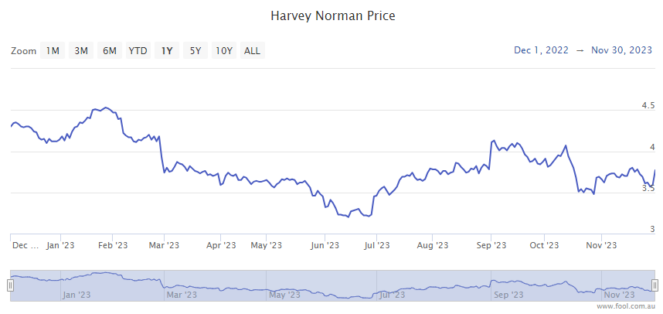

Harvey Norman Holdings Limited

What it does: Harvey Norman is an Australian-based retailer with a mix of company-operated and franchised stores locally and in seven other countries. As of 30 June 2023, the electronics and furniture seller touted 308 stores globally, 197 of which were franchised complexes in Australia.

By Mitchell Lawler: It's been a tough old 12 months for Harvey Norman. The tightening of consumer spending has dented the retailer's sales, leading to a weaker bottom line.

A 7.8% decline in aggregated sales revenue for the first 21 weeks of FY2024 was revealed on Wednesday. Notably, sales through Australian franchisees were hardest hit as Aussie households clamp down as the cash rate has grown to 4.35%.

However, I'd argue this is simply the nature of the economic cycle. At roughly nine times earnings and a 6.6% dividend yield, this established retailer looks undervalued, in my opinion. Not to mention the potential boost from increased immigration to Australia.

Motley Fool contributor Mitchell Lawler does not own shares of Harvey Norman Holdings Limited.

Telstra Group Ltd

What it does: Telstra is a company that needs little introduction. It is the largest telco on the ASX and in Australia and the leading provider of mobile and fixed-line internet and communication services in the country.

By Sebastian Bowen: Telstra shares continue to look compelling to me as a reliable source of passive income.

For one, Telstra has a highly stable earnings base, making it a great defensive investment. Think about what you'd be willing to give up before your mobile internet or home broadband. The answer probably proves the above thesis.

But Telstra shares have also come off the boil recently. The company is down significantly from the 52-week highs we saw earlier this year, and you can buy them today for around the same price as you could have in mid-2019.

However, since then, Telstra has boosted its annual dividend. Today, you can buy the shares on a fully-franked yield of around 4.5%. In my view, that's a great place to start if you want some reliable passive income this December.

Motley Fool contributor Sebastian Bowen owns shares of Telstra Group Ltd.