2024 is fast approaching, and with it comes the growing expectation of future interest rate cuts. Those abundant cash earnings in savings accounts could soon dwindle, which is why I'd be buying high-quality ASX dividend stocks instead.

I'd set and forget these ASX dividend stocks

The Organisation for Economic Co-operation and Development (OECD) and billionaire investor Bill Ackman are already considering the prospects of the Reserve Bank of Australia and Federal Reserve cutting rates next year.

A warning from Ackman, "We're betting that the Federal Reserve is going to have to cut rates more quickly than people expect.", said the Pershing Square fund manager.

Likewise, strategists at investment bank Goldman Sachs have cautioned investors that they're 'too defensively' positioned at this point in the rate cycle.

Hence, I would substitute my lazy savings with dividend-payers with compounding potential.

Sonic Healthcare Ltd (ASX: SHL)

Despite being the thirty-third largest company by market capitalisation in the S&P/ASX 200 Index (ASX: XJO), little mention is made of this cornerstone to the healthcare system. Now valued at $13.7 billion, Sonic holds a global presence yet arguably still presents room for growth.

Irrespective of whether the Australian and/or global economy slows, Sonic Healthcare's services will remain in use. For most people, getting a blood test or X-ray is a non-discretionary expense due to the importance of their health.

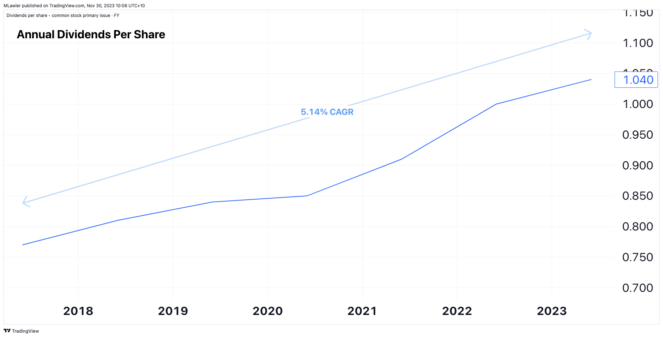

This ASX dividend stock is currently offering a trailing yield of 3.6%. That may not sound remotely interesting compared to 5% on savings. However, Sonic has a 30-year history of steadily growing its dividends, which means the future yield on the original cost basis years from now could be rewarding.

In the past five years, annual dividends have grown at a 5.1% compound annual growth rate (CAGR), as shown above. Yet, Sonic Healthcare's share price has been stagnant since 2019. I'm personally a buyer of this ASX dividend stock due to the combination of passive income and capital growth potential.

National Storage REIT (ASX: NSR)

Storage… how boring, you might add. As long as it's a great company, boring doesn't worry me one iota. In fact, boring is often beautiful — it can mean less investors paying attention to it, a discounted share price, and less competition.

I considered starting a storage business for a time. Then, I realised investing in an established storage company would be much easier. I believe National Storage is the top pick in the Australian storage industry, wielding an incredibly broad footprint and strong brand.

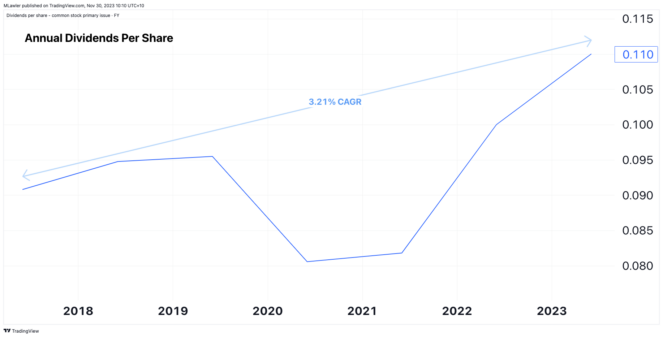

The ASX dividend stock currently yields 5.3%, putting it on par with returns on cash at the moment. Over the last five years, dividends have grown at a 3.2% CAGR — relatively modest.

However, much of the company's cash has been directed towards making acquisitions, a strategy I believe will pay off in spades later on.

Foolish takeaway

As a hat tip to the late Chalie Munger, who sadly passed away yesterday, here is a quote of his:

The big money is not in the buying and the selling, but in the waiting.

Channeling Munger's brilliant mind, the above ASX dividend stocks are all about the waiting. I believe the companies I have mentioned can provide payouts in nearly all conditions.

Furthermore, both are steady, predictable, and even boring businesses. Such are the companies that allow investors to do many years of waiting — right where the 'big money' is often found.