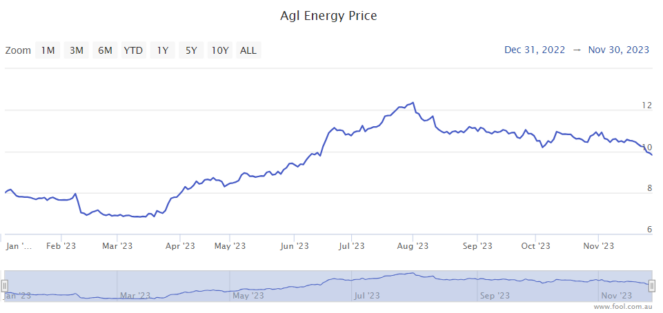

The AGL Energy Ltd (ASX: AGL) share price has been drifting lower over the year. While it's up 20% in the year to date, it has fallen 20% from 1 August 2023, as we can see on the chart below.

The energy company has benefited from a higher earnings environment as wholesale prices increase and plant reliability, availability, and flexibility improve. In FY23, AGL's underlying net profit after tax (NPAT) rose 25% to $281 million.

AGL said it expected underlying NPAT to at least double to $580 million in FY24 and perhaps rise as much as $780 million.

Regarding power prices, AGL explained that profit could rise because of "sustained periods of higher wholesale electricity pricing, reflected in pricing outcomes and reset through contract positions."

In considering the AGL share price, the long-term carries more weight than a short-term timeframe like one month – Christmas is so close! At the time of writing, AGL shares are down 0.8%, trading at $9.61.

The potential of AGL shares

Broker UBS is excited by AGL's potential because of possible earnings growth in the next few years supported by "stronger electricity margins and a full year of additional capacity from Rye Park wind farm".

UBS noted that energy prices could rise because of the impact of some or all of Eraring Power Station capacity being retired by mid-2025. However, the NSW government is talking with Origin Energy Ltd (ASX: ORG) about extending the plant's operation because there isn't enough energy generation to replace it yet.

The broker added that analysis revealed wholesale electricity prices lifted 30% year over year the last time southern weather patterns transitioned from La Nina to El Nino.

UBS believes if AGL can continue to improve generation availability and reliably maintain the flexibility now possible at Bayswater and Loy Yang power stations, "it could provide further upside" to the outlook.

However, wholesale prices have reportedly fallen strongly recently because of a warm winter and a large increase in rooftop solar. But, as the ABC pointed out, wholesale prices can take roughly a year to flow through, so household retail prices may not be impacted for long.

Price target

UBS currently has a 12-month price target of $12.15 on AGL shares, implying it could rise 25% next year.

It seems possible the AGL share price might rise, but the lower wholesale prices may not be helping investor confidence in the longer term.