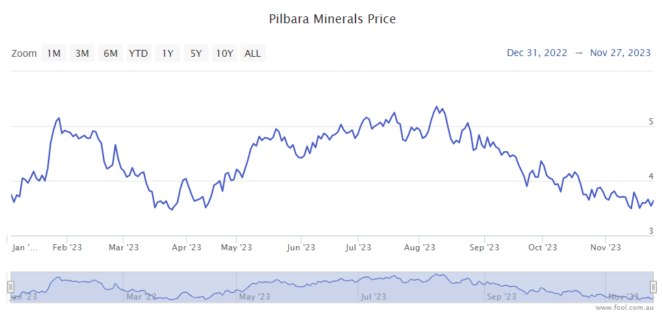

The Pilbara Minerals Ltd (ASX: PLS) share price has seen a lot of pain this year, down 32% from 10 August 2023. But, starting from a low point, the ASX lithium share is almost flat from the start of the calendar year, as we can see on the chart below.

When a share price falls heavily, I like to look at that business to see whether it's a cyclical opportunity.

There are a few good reasons why the Pilbara Minerals share price has fallen, which I'm going to cover first.

Negatives for the ASX lithium share

The biggest negative is that the lithium price has sunk over the past 12 months.

Pilbara Minerals recently reported its performance for the three months to September 2023. It said the realised price for its production was down 47% year over year and down 31% quarter on quarter to US$2,240 per tonne of spodumene concentrate.

The resource price is key for an ASX mining share because it dictates how much revenue and profit it can make. Mining costs don't usually change much month to month, so a reduction of the revenue typically leads to an even bigger decline in profit.

Pilbara Minerals reported that its revenue for the three months to September 2023 sank 43%. As we know, revenue and profit can have a big impact on the Pilbara Minerals share price.

However, Pilbara Minerals has seen an increase in costs like diesel, labour and consumables.

One of the main issues for the lithium sector is that demand is slowing in China just as more lithium production is coming online. Pilbara Minerals itself is adding production with the ramp-up of its P680 primary rejection facility expected to be complete by the end of the second quarter of FY24.

With all of this going on, it's understandable why the lithium price and the Pilbara Minerals share price have fallen in recent months.

Positives about the Pilbara Minerals share price

I believe it's very likely (but not guaranteed) that lithium demand is going to keep increasing over the long term because of the growth of the number of electric vehicles.

We've seen with iron ore how demand from China can change quite quickly, both positively and negatively. While Chinese lithium demand may not be as strong right now, I think it would be unwise to think these weaker conditions will last forever.

Even if the lithium price does stay where it is right now, I like the company's plans to grow profit in the longer term. It's planning to increase its annual production to 1 million tonnes per annum of spodumene concentrate. The company wants more exposure to the lithium value chain, where it's investing in a lithium hydroxide facility in South Korea with partner POSCO.

The company also has an excellent balance sheet, with $3 billion of cash, which I believe provides significant support to the valuation.

Foolish takeaway

I thought the ASX lithium share had fallen far enough to make an investment, though it's certainly not anywhere near the biggest position in my portfolio.

Over the longer term, I believe the supply and demand scales will tip back towards demand and help increase the lithium price. I'm hoping that in two or three years the company could see better conditions for lithium.