High-yield ASX dividend share Rural Funds Group (ASX: RFF) looks like an attractive opportunity at its current valuation, in my opinion.

Higher interest rates have heralded a painful period for real estate investment trusts (REITs). Investors have had to adjust how much they think commercial properties are worth when safer assets like bonds now offer much better returns. Plus, most REITs carry significant debt — and debt has become much more expensive.

Rural Funds Group owns a diversified portfolio of Australian agricultural assets in five core sectors. Its assets are predominantly leased to corporate agricultural operators.

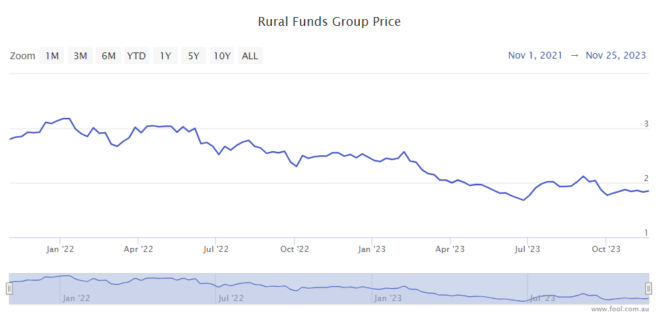

With the Rural Funds share price down around 40% from the end of 2021, it seems much better value. Indeed, the new high-interest era has been priced into the Rural Funds share price, as you can see on the chart below.

That said, I really like this company and I'd be happy to buy more units of this REIT for (at least) three reasons.

Stronger yield

When a share price falls, it increases the dividend yield of an ASX share if the dividend payout in dollar amounts remains the same.

For example, if a company has a 5% dividend yield and the share price falls by 10%, the yield on offer becomes 5.5%.

As I've mentioned, the Rural Funds share price has sunk 40%, which has pushed up the distribution yield to 6.2%.

I like that as a starting yield. It's more than you can get from a savings account and I believe the REIT can keep growing its payout over the long term with rental income growth built into its contracts thanks to indexation.

These are mostly fixed annual increases, or linked to inflation. Plus, a lot of the ASX dividend share's debt has been hedged with an interest rate of 2.83% in FY24, 2.8% in FY25, and 2.71% in FY26, protecting it from higher rates.

Attractive valuation

At the end of FY23, the company said it had an adjusted net asset value (NAV) per unit of $2.93. The current Rural Funds share price is trading at a 36% discount to this value.

I'm not sure that Rural Funds would be able to get the book value for all of its farms if it were to sell them, but I do think this represents a large discount to their underlying value.

Rural Funds is producing real rental profit every year. In FY24, management projects the REIT to generate 11.2 cents per unit of adjusted funds from operations (AFFO).

This represents the company's net rental profit which will soon benefit from developments and productivity improvements.

Investments are getting closer to paying off

Every month, the REIT is closer to seeing its rental profits increase materially as investment developments are completed.

A key focus of the ASX dividend share is its macadamia developments in Queensland. Rural Funds has signed a 3,000-hectare, 40-year lease with investment group TRG which started in FY23.

Every year that Rural Funds invests more into its macadamia farms, it effectively increases its rental income. The forecast rental capital base for the macadamia developments was $139 million in FY23. It's expected to rise to $244 million in FY24, $277 million in FY25, and $309 million in FY26.

At the same time, the rental income from them was $8 million in FY23. That's forecast to rise to $16 million in FY24 and $21 million in FY25.

Rural Funds also points out that it's also active in other productivity developments. One example is on three cattle properties prior to their leasing. These have a combined asset value of $120.6 million.

I like that the company is investing steadily across its asset base to increase the rental potential and underlying value. This should help long-term returns, including bigger distributions.