Here at The Fool, we don't mind a bit of crystal ball gazing on investment, because it's kinda fun and we're adorably geeky that way.

Of course, we know that what the experts predict will happen next year may or may not eventuate.

As investors, we understand that the proverbial can hit the fan and catch us unawares at any time.

That's called a black swan, by the way. An unexpected negative event that tramples all over our stock valuations for a period. A once-in-a-century pandemic, for example. But I digress.

It's also worth remembering the old adage that investment success is not about timing the market, but time in the market. That's why The Fool advocates long-term investment as opposed to trading.

Thus, no matter what the crystal ball says about likely events next year, the timing of our investments should really come down to when it suits us personally.

That is, when we can afford it and when we have a strategy in place for long-term wealth creation.

With all that said, let's examine the views of two experts and see what they think is likely to happen with shares vs. property in 2024.

What's next for shares vs. property in 2024?

Let's start with bricks and mortar.

Our expert is Louis Christopher, the Head of Research at SQM Research. He's one of Australia's most experienced property price researchers and analysts.

Christopher has just released his annual Housing Boom and Bust Report 2024.

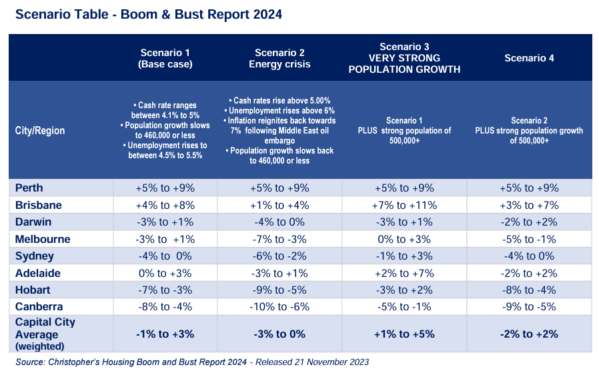

The especially great thing about this report is that Christopher provides a base case scenario, plus a few other scenarios, to give us a well-rounded view of what may happen to property prices under various macroeconomic circumstances. Cool, huh?

Sydney and Melbourne likely to fall

As shown in the chart above, the base case — or most likely scenario, in Christopher's view — is a cash rate of between 4.1% and 5%, continued strong population growth of 460,000 people or less (that's a bit less than 2023 growth), and Australia's unemployment rate moving to between 4.5% and 5.5%.

The alternative scenarios include a global energy crisis and much stronger population growth.

The base case sees Sydney and Melbourne home values either falling or recording anaemic growth. Christopher forecasts -4% to 0% movement for Sydney and -3% to +1% movement for Melbourne.

These two cities are typically the biggest beneficiaries of migration, and if you put continuing strong population growth together with a critical housing supply shortage, we get a reasonably effective offset against rising unemployment, which will limit how far prices may fall in each city overall next year.

But these are expensive property markets. Sydney is the most expensive, with a median house price of $1.12 million, and Melbourne is third-most pricey, with a median of $778,000, according to CoreLogic data.

That means plenty of Sydney and Melbourne householders have big home loans, and Christopher reckons the affordability challenges emanating from higher interest rates will begin to show in 2024.

However, he expects Sydney and Melbourne's prestige sector to continue to do well, benefitting from rising foreign buyer demand. In both cities, he tips apartment price growth to outperform houses.

He said:

The interest rate rises of 2022, 2023 and possibly 2024 will finally start to bite homeowners and would-be homebuyers alike. Distressed selling activity is expected to jump, especially in NSW where we are already starting to see a new trend upwards in that data set.

Canberra could get smashed while the mining capitals surge

Canberra is currently Australia's second-priciest housing market, with a median house price of $961,000.

It has decoupled from the other smaller states and territories to join Sydney and Melbourne at the top of the home valuations tree.

Christopher is tipping a fall in Canberra home values of between -8% and -4% next year. This will be due to reduced Federal Government spending and rising housing supply due to a strong pipeline of new apartment completions.

Meanwhile, Christopher predicts 5% to 9% price growth in Perth and 4% to 8% growth in Brisbane in 2024.

This would be caused by stronger commodity prices brought about by an anticipated uplift in Chinese demand for iron ore.

Most of Australia's mining activity is centred on Western Australia and Queensland, and the families of mining workers often live in the nearest capital cities, adopting a FIFO lifestyle.

Higher demand for commodities could mean more mining industry jobs and higher wages, which would then flow through to property values in the capitals.

Christopher said:

Perth and Brisbane are still very likely to record price rises based on super tight rental conditions, a better-than-expected global commodities market and minimal exposure to the financial services sector, where we believe there maybe be significant job losses.

The Adelaide and Darwin markets are likely to remain steady or record a minor price rise or correction. The base case forecast is price growth of 0% to 3% in Adelaide and -3% to +1% in Darwin.

What about rents?

Well, it's good news for landlords with residential real estate investments. Christopher tips asking rents to keep rising by between 7% and 10% across Australia next year.

He expects Perth rents to increase the most — by a whopping 12% to 15%.

By the way, we recently looked at whether soaring rents are delivering better returns than dividends for investors.

Now, let's move on to the 2024 outlook for ASX shares and how that compares vs. property.

What's the outlook for ASX 200 shares in 2024?

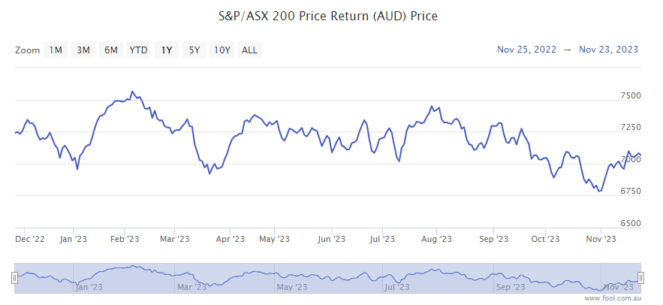

As my Fool colleague Tristan recently reported, top broker Morgan Stanley has a 12-month target of 7,350 points for the benchmark S&P/ASX 200 Index (ASX: XJO).

The ASX 200 closed at 7,040.8 points on Friday.

We've seen sluggish capital growth of 1.36% in 2023 amid much volatility.

If Morgan Stanley has it right, ASX 200 share investors are looking at potential capital gains of 4.39% over the next 12 months.

Morgan Stanley particularly likes the look of ASX mining shares in 2024. It reasons that commodity prices will stay strong and the weaker dollar will remain beneficial, too.

As a result, the broker's model portfolio currently has larger positions in BHP Group Ltd (ASX: BHP), Rio Tinto Ltd (ASX: RIO), energy shares, healthcare shares, and insurance shares.

Shares vs. property in 2024: Which wins on predicted gains?

Based on our expert views, ASX 200 shares are tipped to do better vs. property in 2024 in terms of capital gains.

Morgan Stanley is predicting 4.39% growth for ASX 200 shares over the next 12 months.

By comparison, Christopher's overall base case for the combined weighted capital cities is -1% to +3%.

For further reading, check out ASX shares vs. real estate investment: Which wins on 10-year returns?