It has been an incredible year for the S&P 500 Index (INDEXSP: .INX) to date. As we can see on the chart below, the S&P 500 Index has gone up by 19%.

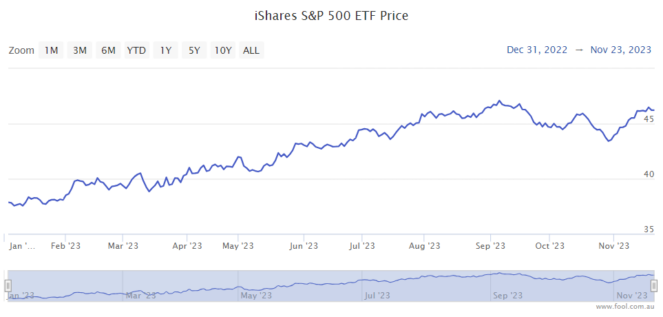

On the ASX, investors can access the returns of the S&P 500 with the exchange-traded fund (ETF) iShares S&P 500 ETF (ASX: IVV). The IVV ETF has risen by more than 23% in 2023, as we can see on the chart below because it's measured in Australian dollar terms, and the Aussie dollar has weakened during the year, boosting returns for Aussies.

But as we know, recent past performance is not a guarantee of future performance at all, particularly when it comes to the overall share market.

Let's look at the potential 2024 outlook for the US share market and the S&P 500.

New record predicted

According to reporting by the Australian Financial Review, Bank of America believes the S&P 500 is set for a new high in 2024 and it could hit 5,000. It's currently at around 4,560.

The AFR quoted Savita Subramanian from Bank of America who said the bank's investment analysts are bullish on US shares in 2024 "not because we expect the Fed to cut, but because of what the Fed has accomplished. The market has absorbed significant geopolitical shocks already… US exceptionalism is intact."

Bank of America thinks the American economy isn't running too hot or too cold. But, Subramanian suggests that data reveals most investors are still bearish. "Bull markets typically end with high conviction and euphoria — we are far from that."

Stay patient and be selective

Morgan Stanley recently released an investment article that suggested investors "will need to make deliberate choices in 2024, paying close attention to monetary policy if they want to avoid a variety of potential pitfalls and find opportunities in an imperfect world of cooling but still-too-high inflation and slowing global growth." That's something to think about with the S&P 500, in my eyes.

The investment bank thinks markets are priced as though central banks will correctly balance the transition to lower levels of inflation, meaning there is "limited runway for increased valuations."

However, Morgan Stanley is positive on income investing with there being "bright spots in high-quality fixed income and government bonds in developed markets, among other areas."

Getting through this last period of higher inflation is "likely to lead to slower growth, particularly in the US, Europe and the UK." China is expected to see "tepid growth", according to Morgan Stanley.

Morgan Stanley's strategists recommend that investors "stay patient and be selective. Risks to global growth—driven by monetary policy—remain high, and earnings headwinds may persist into early 2024 before a recovery takes hold."

Mike Wilson, chief investment officer and chief US equity strategist for Morgan Stanley, thinks the second half of 2024 could be positive after a possible sell-off in the first half:

We think near-term uncertainty will give way to a comeback in U.S. equities. Positive operating leverage and productivity growth from artificial intelligence should lead to margin expansion.

Mike Wilson suggests there could be continuing "robust" earnings growth going into 2025, which could be positive for the S&P 500 considering share prices usually follow profit over the longer term.