There are articles everywhere, including on this website, that tell you to buy this and buy that.

But it's easier said than done when the world seems so troubled.

People are struggling with a massive rise in the cost-of-living due to rampant inflation and 13 interest rate hikes. There are wars in Europe and the Middle East. Australia's largest trading partner, China, is struggling to jump-start its economy. Global warming continues unabated.

Who can blame anyone that feels shy about splashing cash on investments in times like these?

Fortunately AMP Ltd (ASX: AMP) chief economist Dr Shane Oliver this week revealed his nine rules to help calm investor nerves and reduce stress:

1. Use the power of compounding

If you're a regular reader, you might think we bang on about compounding too much. But we mention it so often because it really is that powerful.

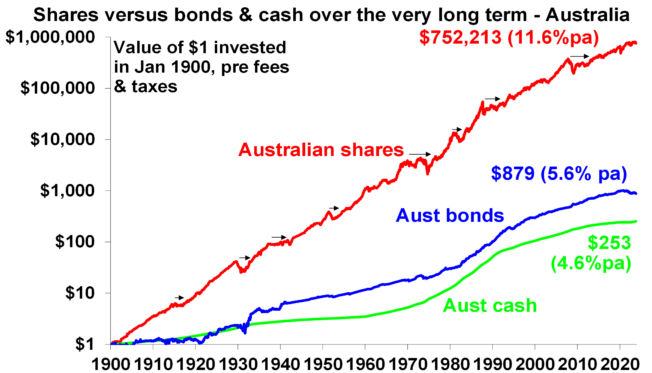

"The best way to build wealth is to take advantage of the power of compound interest and have a decent exposure to growth assets," Oliver said on the AMP blog.

"Of course, there is no free lunch and the price for higher returns is higher volatility but the impact of compounding returns from growth assets is huge over long periods."

2. Don't worry about the cycle

Both the economy and the share market eternally goes through boom-bust cycles.

The trick is to ignore which part of the cycle you think we're in.

"Looked at in a long term context, the 20% or so plunge in share seen into October last year was just another cyclical swing, after which markets rebounded.

"The key is not to get thrown off when markets plunge."

3. Invest for the long term

This is another axiom that The Motley Fool espouses ad nauseum.

And again, we repeat the mantra because it's true.

Oliver reminded investors not one person in the world has the ability to predict what will happen to stock markets.

"If getting markets right were easy, then the prognosticators would be mega rich and would have stopped doing it," he said.

"Given the difficulty in getting market moves right in the short-term, for most it's best to get a long-term plan that suits your level of wealth, age, tolerance of volatility, and stick to it. Focus on the green 20-year return line in the previous chart rather than short term swings."

4. Diversify

This is another basic rule that sometimes is ignored by greedy investors, only to burn them badly later.

Oliver said diversification helps "smooth out the ride".

"For example, global and Australian shares provide similar returns over the very long term but go through long periods of relative out and underperformance."

5. Turn down the noise

This one's easier said than done in the era of the internet and 24-hour news cycles.

The trouble is, according to Oliver, much of the information bombardment is "poor quality".

"This has gone into hyperdrive since the pandemic – with a massively stepped up flow of economic information.

"This may be of use in providing timely information on how the economy is travelling but it's also added immensely to the flow of information and often it's contradictory."

He urged investors to focus on just a few reliable sources for investment news and switch off notifications on your smartphone.

"Don't check your investments so regularly."

6. Buy low, sell high

We know from rules two and three that it's impossible to time the market.

However, for individual shares you can try to prevent yourself from buying something at a too expensive price or sell for cheap.

This might seem obvious, but Oliver warns many investors don't do it.

"Unfortunately, many do the opposite, i.e. selling after a collapse and buying after a big rally, which just has the effect of destroying wealth even though it might feel good at the time in the midst of a panic (or euphoria)."

7. Be careful of the herd

Humans have a herd mentality and find it comforting to do the same as what others are doing.

But this could be counter-productive in investing.

"At extremes the crowd is invariably wrong, whether it's at market highs like in the late 1990s tech boom or market lows like in March," said Oliver.

"The problem with crowds is that eventually everyone who wants to buy in a boom (or sell in a bust) will do so and then the only way is down (or up after crowd panics)."

8. Look at the cash flow

If you're having trouble deciding whether to buy into a particular investment, just look at the cash flow.

"If an investment looks too good to be true it probably is," said Oliver.

"By contrast, assets that generate sustainable cash flows (profits, rents, interest) and don't rely on excessive gearing or financial engineering are more likely to deliver."

9. The final rule

The last thing Oliver urged was for punters to obtain quality financial advice.

This is because even the most seasoned investors can fall prey to "psychological traps", such as over-reacting to current world events or only paying attention to information that reinforces their own beliefs.

"A good approach is to seek advice via an investment information and/or advisory service or a coach such as a financial adviser, in much the same way you might use a specialist to look after your plumbing or medical needs.

"As with plumbers and doctors, it pays to shop around to find a service or adviser you are comfortable with and can trust."