ASX lithium shares have been flogged to death as an investment theme the last few years, so are there any real bargains left any more?

It may surprise you that there definitely are.

The global price for the battery ingredient has significantly cooled off this year, meaning valuations for many lithium producers are down from a year ago.

But in the longer run, many experts say there will be plenty of demand for the mineral as the transition to net zero will necessitate the production of more and more batteries.

Here are two lithium stocks that Argonaut associate dealer Harrison Massey likes right now:

Sitting on massive piles on lithium

Massey is bullish on Global Lithium Resources Ltd (ASX: GL1), which is an exploration outfit that owns the Manna and Marble Bar sites in Western Australia.

"Global Lithium has a combined mineral resource of 54 million tonnes at 1.09% lithium oxide," Massey told The Bull.

"The company is undertaking a 50,000-metre reverse circulation and diamond drilling program, which could further upgrade the mineral resource estimate in the first half of fiscal year 2024."

Massey is far from the only fan of Global Lithium.

"Mineral Resources Ltd (ASX: MIN) owns 9.6% of the shares on issue."

And according to CMC Markets, all six analysts that currently cover the stock rate it as a buy.

The Global Lithium stock price has almost halved from a year ago, but perhaps that's part of the attraction.

Nine analysts love this ASX lithium stock

Patriot Battery Metals Inc CDI (ASX: PMT), which is Massey's second pick, is a Canadian company listed on the ASX.

Despite the freefalling lithium price, this year has been a milestone for Patriot Battery Metals.

"Earlier this year, the company announced a significant maiden resource of 109.2 million tonnes at 1.42% lithium oxide, which put the asset on a globally significant scale."

Last month saw exciting news that could potentially turn into a massive catalyst.

"In October, the company announced the discovery of a new mineralised high-grade zone called CV13, with sample sizes of between 3% to 5% lithium oxide near the surface," said Massey.

"We expect Patriot to release an array of assay results in the next six to nine months, which could further increase its resource estimate."

Massey's peers are also in unanimous agreement on this one too.

All nine analysts that research Patriot Battery Metals are rating the stock as a buy, as shown on CMC Markets.

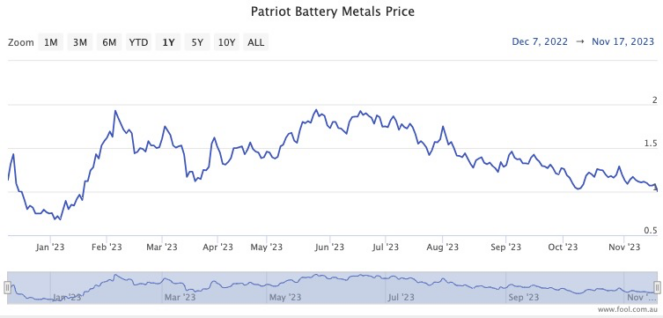

The Patriot Battery Metals price has dropped almost 20% over the past 12 months.