ASX growth shares with plenty of potential to become much bigger are really attractive opportunities to me. The two stocks below still seem really cheap. Indeed, they look like bargains.

I love having the chance to 'buy the dip' on businesses that are choosing to become operationally larger despite the uncertain conditions. I think they'll come out the other side in a much better place.

Let's get into why I like these two stocks.

Lovisa Holdings Ltd (ASX: LOV)

Lovisa is an ASX retail share that sells affordable jewellery to younger shoppers. The Lovisa share price is down 20% in 2023 to date and has fallen over 30% from April 2023, as we can see on the chart below.

I think the opportunity here is with the enormous rollout of stores the company is embarking on.

The business has around 170 stores in Australia and had approximately 800 outlets globally at the end of FY23.

At that time, it had 190 stores in the US and has only recently entered several new markets including Canada, Mexico, Spain, Hong Kong, Taiwan, and plenty more.

At the current rate Lovisa is growing its store numbers, I believe the ASX growth share's global network can double in size by FY28. This could be a massive financial tailwind and enable the business to perhaps double its profit and dividend by FY28 as well. There's also a fair chance it could enter mainland China in the next 12 months, which would be a huge potential market to tap into.

Looking at the projections on Commsec, the Lovisa share price is valued at 19x FY25's estimated earnings and it could pay a partially franked dividend yield of 4.3% in FY25.

Pinnacle Investment Management Group Ltd (ASX: PNI)

Pinnacle is a business that invests in fund managers who are starting their own funds management businesses. Pinnacle can assist them with a number of areas like seed funding, distribution services, legal, compliance, and so on.

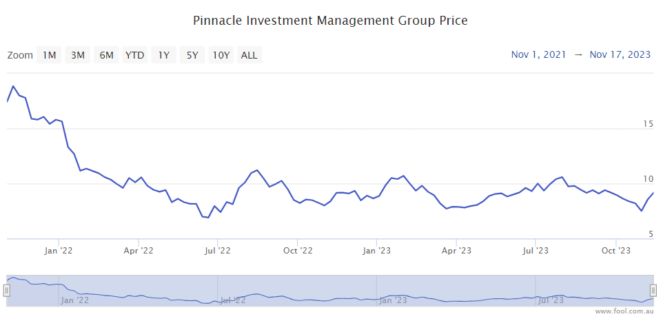

Since 1 August 2023, the Pinnacle share price has fallen around 15%, and it's down 50% from November 2021, as we can see on the chart below.

I think this is a great business to pick up when markets are uncertain. When declines happen, it hurts both the existing funds under management (FUM) and may also make people hesitant about investing with fund managers, affecting net inflows. I believe the opposite will be true when conditions seem more positive.

Pleasingly, a significant amount of underlying funds have delivered long-term outperformance of their respective benchmarks. Pinnacle is seeing underlying net inflows – in the FY23 second half, it experienced $3.1 billion of net inflows.

There are a few positives that could drive the ASX growth share's earnings. Existing fund managers can keep experiencing inflows for existing funds, they can start new funds, or start new investment strategies (for example ASX small caps). Plus, Pinnacle is adding to its portfolio of management investments, one of the newest is a Canadian-based manager.

Since the company started paying a dividend in 2016, it has grown its dividend almost every year, aside from 2020 when it maintained its payout.

According to projections on Commsec, the Pinnacle share price is valued at under 20x FY25's estimated earnings with a possible FY25 grossed-up dividend yield of 6.5%.