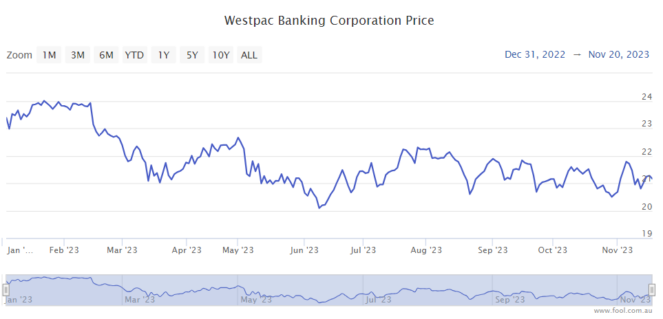

The Westpac Banking Corp (ASX: WBC) share price has been going in the wrong direction over the past 12 months. In fact, it's down more than 11%, as we can see on the chart below.

It goes without saying investors shouldn't focus too much on a short-term investment timeframe like a month. It's the long-term that counts. But we can consider whether the ASX bank share is good value today or not.

The ASX bank share reported a strong FY23 result with many numbers going the right way. Profitability usually has a large influence on investor thoughts on share valuations.

Earnings recap

Westpac reported net profit after tax (NPAT) grew by 26% to $7.2 billion and earnings per share (EPS) rose 28% to $2.05.

Loans increased 5% to $773 billion, the bank's return on equity (ROE) improved by 199 basis points (1.99%) to 10.1%, and the common equity tier 1 (CET1) capital ratio increased 109 basis points (1.09%) to 12.4%.

The bank also said its margins increased by two basis points (0.02%) and had been "well managed through a period of intense mortgage competition". Westpac managed to decrease its expenses by 1%, though said there's "more work to do" as it works on lowering its cost-to-income ratio relative to peers.

However, the bank did say impairment provisions were increased to position the bank's balance sheet "appropriately" for the uncertain economic outlook.

Certainly, I think the banks are in a tricky position. If they want to win — or protect — market share, then they need to offer competitive loans. Most lenders are doing just that, so there's pressure on net interest margins (NIMs).

Can the Westpac share price rise to $23?

The Westpac share price was trading above $23 in February 2023, so it's not as though it's an impossible valuation. But that share price was before it became apparent that ASX bank share sector margins were being challenged through competition.

Broker UBS thought the FY23 result was a positive and it upgraded its price target on Westpac by $1. A price target is where an analyst thinks the share price will be in 12 months from now. However, that price target was increased from $20 to $21, so UBS is saying the Westpac share price could be close to where it is today in 12 months' time.

The broker has a sell rating on the bank, though it acknowledged "better-than-expected bad debts as asset quality continues to surprise on the upside and marginal cost downgrades to FY24". UBS is wary of costs increasing from here and also sees difficulties for the NIM.

At the current Westpac share price, UBS values the bank at 11.5 times FY24's earnings estimate. It could also pay a grossed-up dividend yield of around 9.5%.