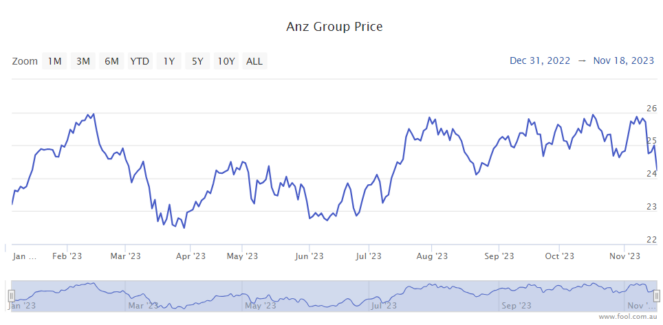

The ANZ Group Holdings Ltd (ASX: ANZ) share price has seen plenty of ups and downs in 2023. As we can see on the chart below, it's up 4.6% since the start of the year, but that includes falling 6.7% from 9 November 2023.

Investors shouldn't focus too much on what the share price might do in a short-term timeframe such as a month or two. The ASX share market is very unpredictable over short-term timeframes.

Long-term shareholders can just hold through the volatility, while prospective investors can wait for a good price to buy – we don't have to invest today.

It wouldn't be outrageous for the ANZ share price to reach $28 because it briefly reached that level in 2022 and managed to reach that valuation a few times during 2021.

How are things going for the ASX bank share?

It was only last week that the ASX bank share reported its FY23 result. Seeing as investors are usually focused on profit (and dividends) when determining what the right ANZ share price is, let's remind ourselves how the bank performed.

In the 2023 financial year, ANZ's statutory net profit after tax (NPAT) was flat at $7.1 billion, while the continuing operations cash profit was $7.4 billion (up 14%). Continuing operating cash profit before credit impairments and tax rose 20% to $10.75 billion. The annual dividend per share was increased by 20% to $1.75.

I'd pay less attention to the 20% growth figure and more to the 14% growth figure – credit impairments are an influential part of a bank's operations and profit.

ANZ's gross loans and advances grew 5% to $710.6 billion and the bank said that ANZ Plus – its new retail business – is creating benefits, having now reached over 500,000 customers. The cost of operating ANZ Plus is "materially lower" than its existing retail business and it's seeing "high levels of customer engagement and satisfaction."

Pleasingly, the Australian commercial segment, which was the highest returning division, delivered 11% revenue growth in the year, with lending growth to $62 billion.

Could the ANZ share price reach $28?

ANZ said that it's expecting to manage costs and grow its commercial business. The bank said the external environment is "likely to remain challenging", with the full impact of higher interest rates expected to impact economic activity as well as household and business budgets.

There has been a "relatively low level" of delinquencies despite the high interest rate.

The broker UBS recently changed its rating to neutral, with a price target of $25. That means the broker is expecting the ANZ share price to rise by around 4% over the next year. So, UBS doesn't think it'll reach $28 in 12 months, let alone two months.

UBS is concerned that ANZ's aim of growing its mortgage market share could hurt the net interest margin (NIM). There's pricing pressure on the term deposit side of things, the potential of rising arrears and the broker doesn't think the market has reduced its NIM assumptions yet.

But, as a reminder, UBS is expecting an improvement in the ANZ share price and thinks it could pay an FY24 grossed-up dividend yield of more than 8%.