Earlier we looked at whether supermarket giant Woolworths Group Ltd (ASX: WOW) is a buy, sell or hold.

This time it's time to break down what's happening with its big retail rival Coles Group Ltd (ASX: COL).

Like Woolworths, Coles shares have performed poorly considering the current climate of consumers cutting back their spending down to the essentials.

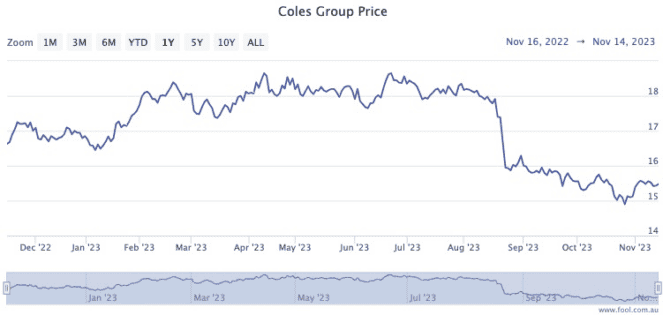

The stock price is down 5.7% so far this year. But the valuation has been especially under pressure in recent weeks, plunging more than 15.3% since the start of August.

Is this S&P/ASX 200 Index (ASX: XJO) stock worth a run in your portfolio?

'Compelling value' or shrinking dividend?

Once again, the answer is similar to Woolworths.

Only four out of 16 analysts currently surveyed on CMC Markets reckon Coles is a buy right now.

Meanwhile, seven rate it as a hold and five professionals recommend selling.

The Motley Fool's Sebastian Bowen is of the opinion that investors should take advantage of the low price to buy $10,000 worth of Coles shares as a defensive play.

"I think Coles is offering compelling value today," he said.

"Most consumer staples shares tend to be viewed as safe havens by investors. In Coles' case, this comes down to how vital the food and household essentials that the company provides are for its customers, regardless of the economic weather."

Goldman Sachs Group Inc (NYSE: GS) analysts are in the bearish camp, predicting the supermarket chain would miss analysts' forecasts.

"Our FY25/26 EPS remains 13% to 14% below Factset consensus," read its notes.

"At target price of $14.70, the TSR [total shareholder returns] is 2% and it is a sector-relative call with Coles having bottom quartile TSR amongst our coverage."

Over the 2023 financial year, Coles' debt pile grew and there is a distinct chance that could happen again in the current year.

"If profit falls and capital costs are high, the supermarket business may decide to pay a smaller dividend," said The Motley Fool's Tristan Harrison last month.

"Taking on more new debt, with a high-interest cost, to pay a larger dividend could be counterproductive for long-term success."

Coles currently pays a dividend yield of 3.94%, fully franked.