Top ASX shares paying dividends can be attractive investments. If those stocks are delivering enormous dividend increases, then investors can benefit from strong compounding.

Good dividend growth is normally a sign that the company's earnings are growing strongly and management is confident about the balance sheet.

These are three that are growing dividends at an impressive rate.

Australian Ethical Investment Ltd (ASX: AEF)

Australian Ethical is a fund manager that invests in businesses that it believes are ethical and can align with an investor's morals.

The business is benefiting from a steady inflow of investor funds thanks to superannuation contributions, providing a regular boost to funds under management (FUM).

In FY23 the business delivered underlying net profit after tax (NPAT) growth of 15% to $11.8 million. This helped the company grow its annual dividend per share of 7 cents, up 17%.

In the three months to September 2023, it saw positive net flows of $114 million and it added more customers.

I think its FUM could be significantly larger in five years, and the Australian Ethical share price is down 65% from the end of FY23.

Johns Lyng Group Ltd (ASX: JLG)

I recently invested in this top ASX share for my own portfolio. It specialises in providing restoration services across Australia and the US after insured events including impact, weather and fire events. It's seeing more activity following the increased level of expensive storms and flooding. Major clients include insurance companies, governments, body corporates/owners' corporations and so on.

The business is also expanding with acquisitions into different sectors including owning body corporate managers, as well as smoke alarm, electrical and gas compliance, testing and maintenance services, fire and essential safety services.

In FY23 it delivered NPAT growth of 64.3% to $62.8 million, which enabled 57.9% growth of the annual dividend to 9 cents per share. I'm not expecting this level of dividend growth to continue forever, but I do believe its dividend can keep growing in the double-digits.

It's expecting its business-as-usual earnings before interest, tax, depreciation and amortisation (EBITDA) to grow by 20.1% in FY24.

Propel Funeral Partners Ltd (ASX: PFP)

Propel is one of the largest funeral operators in Australia and New Zealand. It's a bit morbid, but the company is benefiting from ageing demographics, with the number of funerals expected to slowly but steadily increase over the next decade.

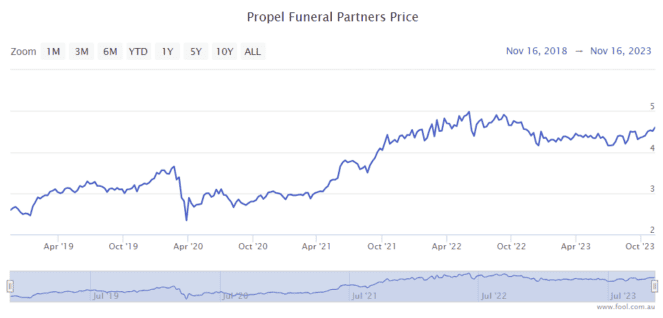

This top ASX share has seen its share price rise by more than 80% over the last five years, as we can see on the chart below.

Inflation has also enabled the business to increase funeral prices. This, combined with more funerals, is enabling solid revenue growth. In FY23, revenue grew 16% while operating net profit grew 17.9%.

The company's board decided to grow the annual dividend by 14% to 14 cents per share.