ASX 200 insurance stock Steadfast Group Ltd (ASX: SDF) is in a trading halt amid news of a $280 million capital raising and acquisition.

The Steadfast share price was frozen at $5.41 per share on Thursday.

Trading is expected to resume once the company announces the completion of the institutional component of the capital raise or at the start of trading on Friday — whichever comes first.

Steadfast is acquiring the Sure Insurance underwriting agency, which provides home and contents insurance in regional Queensland.

It is conducting a $280 million fully underwritten institutional placement and a non-underwritten share purchase plan for retail shareholders to raise an additional $30 million to help fund the purchase.

The company also released a trading update for FY24 and upgraded its profit guidance for the year.

Let's take a look at the details.

Steadfast to acquire Sure Insurance

In a statement, Steadfast Group announced an agreement to acquire 70% of the equity interest in

Combined Agency Group Pty Limited, which trades as Sure Insurance.

Steadfast said the acquisition would be earnings per share (EPS) accretive in the first full year.

Consideration comprises a fixed, non-refundable upfront cash payment of $148.8 million plus two potential earn-out payments based on FY24 and FY25 performance. These are payable at the end of each year (calculated as 10.333x EBITA).

There is a put-and-call option arrangement for up to two-thirds of the remaining 30% equity interest in Sure Insurance at fair market value. The arrangement has an exercise date between September and October 2026. It is to be settled in Steadfast scrip.

The company has scheduled completion for 30 November.

Capital raising

Settlement of the new shares issued under the institutional placement will occur next Tuesday, with allotment scheduled for Wednesday.

Steadfast will determine the price for the new shares during the bookbuild process.

However, the company said the underwritten floor price for the new ASX 200 insurance stock was $5.06 per share.

Eligible retail shareholders will be able to apply for a maximum of $30,000 in new Steadfast shares.

The SPP offer period will commence on 23 November and close at 5pm on 14 December 2023.

The SPP offer price will be the lower of the final institutional placement price or a 1% discount to the volume-weighted average price of the ASX 200 insurance stock over the five trading days ending 14 December.

FY24 trading update and guidance bump

Steadfast reported a "solid first four months of trading, and premium increases from insurers in excess of original guidance assumptions".

The company said its FY24 acquisition program, excluding Sure Insurance, was on track to meet or exceed the $280 million target. It has completed $165 million in acquisitions to date (including ISU Group).

Steadfast said it was upgrading its FY24 guidance range today. The upgrade will reflect positive trading results, the Sure Insurance acquisition, and the capital raise.

The upgraded guidance is underlying EBITA of $520 million to $530 million. This is up from the previous guidance of $500 million to $510 million.

Steadfast also expects a higher underlying net profit after tax (NPAT) in the range of $240 million to $250 million. Previously, the company was guiding $230 million to $240 million.

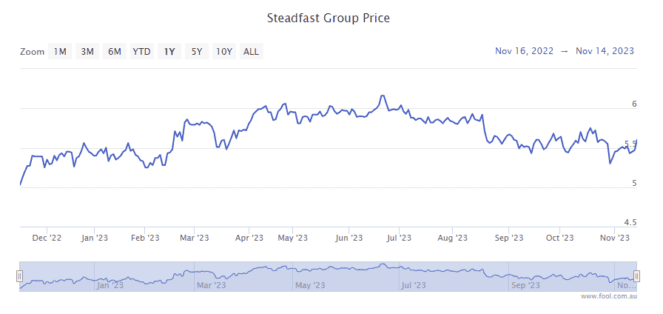

ASX 200 insurance stock flat in 2023

The Steadfast share price is up 0.56% in the year to date.

It has fallen 8.6% over the past six months.