Investment fund manager Wilson Asset Management (WAM) has named two S&P/ASX 200 Index (ASX: XJO) stocks that it thinks are really good value right now.

WAM is always on the lookout for undervalued ASX growth shares where there's a catalyst that could send the share price higher. Sometimes they get it wrong, but they get it right plenty of times too.

For example, the WAM Research Limited (ASX: WAX) investment portfolio has delivered a gross return (before fees, expenses and taxes) of 12.8% per annum since July 2010, compared to an 8% return per annum for the S&P/ASX All Ordinaries Accumulation Index (ASX: XAOA).

Kelsian Group Ltd (ASX: KLS)

This ASX 200 stock was described by WAM as Australia's largest land and marine transport service provider and tourism operator, with operations in Australia, the US, the UK, Singapore and the Channel Islands.

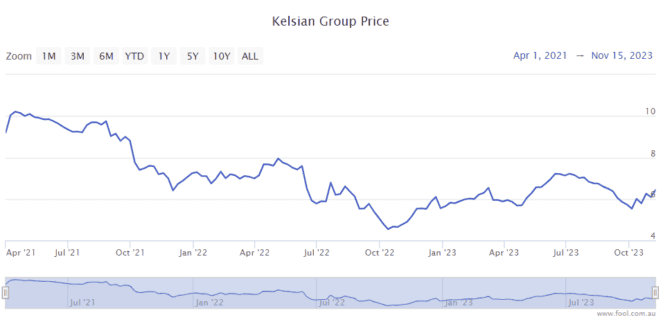

As we can see on the chart below, the Kelsian share price has dropped by over 35% from April 2021.

WAM pointed out that the ASX 200 stock recently gave an update at the AGM which noted the positive outlook for the business.

Its Perth rail replacement project is beginning this month and the company expects growth from its recent acquisition from its US-based motorcoach business called All Aboard America! Holdings.

The fund manager said:

We remain positive about Kelsian Group's contract tender pipeline in both domestic and international markets, and believe its government-backed service contracts can offset inflationary impacts.

Bapcor Ltd (ASX: BAP)

Bapcor claims to be the largest auto parts business in the Asia Pacific region. It sells and distributes vehicle parts, accessories, automotive equipment, services and solutions.

The Bapcor share price responded negatively to a trading update that was weaker than expected.

WAM pointed to Bapcor noting that economic headwinds will continue to impact the growth profile of its trade, wholesale and retail markets in the short-term.

On top of that, the ASX 200 stock's costs are increasing – cost inflation including increasing payroll taxes and higher interest costs has resulted in lower-than-expected year-to-date underlying net profit after tax (NPAT). Revenue growth has also slowed since its FY23 result to a low single growth rate because of the headwinds mentioned above.

The fund manager said:

We continue to believe Bapcor is a high-quality business that is undervalued by the market. What value is it currently trading it? If I look at the projection on Commsec, the Bapcor share price is valued at 15x FY24's estimated earnings.