While the S&P/ASX 200 Index (ASX: XJO) is roughly in line with its historical price-to-earning (P/E) ratio, dozens of quality companies are trading at a discount to the renowned Australian sharemarket measuring stick.

However, 'value' is more than earnings multiple, in my opinion. I try to take a holistic approach when I'm hunting for value among ASX shares — considering balance sheet strength, management quality, future cash flows, and competitive advantages.

When factoring in the range of fundamentals, I'd argue there is one company that emerges as a cut above the rest right now.

An ASX 200 company with charming fundamentals

Without further ado, the company presently atop my buying list is ResMed CDI (ASX: RMD). This industry leader is known for its medical devices for treating sleep apnea and other respiratory conditions.

At an earnings multiple of 23 times, ResMed may not look the 'cheapest' or most value-orientated opportunity among ASX 200 shares. But, these multiples are nearly useless when viewed in isolation.

For example, paying a premium for a company growing its profits at a faster-than-average pace can make sense. Likewise, a business with a more robust financial standing (i.e. less debt, more cash) is oftentimes more valuable than a heavily indebted one.

| ASX 200 Index | ResMed | |

| P/E Ratio | ~17 | ~23 |

| Revenue Growth (1-year) | 10.4% | 20.7% |

| Gross Profit Margin | 25.7% | 54.4% |

| Net Income Margin | 11.3% | 20.7% |

| Net Income Growth (1-year) | -35.0% | 15.3% |

| Debt-to-equity Ratio | 163.6% | 32% |

| Return on Equity (past year) | 11.2% | 21.3% |

As the table above shows, ResMed fundamentally appears like a higher quality company than the ASX 200 Index average. Whether it's the juicier gross margin, better growth rates, or lower debt exposure, this business is exceptional in many regards.

Slimmed down valuation

Despite the enticing fundamentals, the Resmed share price has been gasping for air for the past few months. Shares in the ASX 200 healthcare company are now down 33% compared to a year ago, sliding to their lowest level since pre-2020.

We can comfortably assume the downfall is related to the emergence of weight-loss drugs, such as Ozempic, Wegovy, and Mournjaro. I say 'comfortably' because the company's revenue and profits have only increased over the past 12 months.

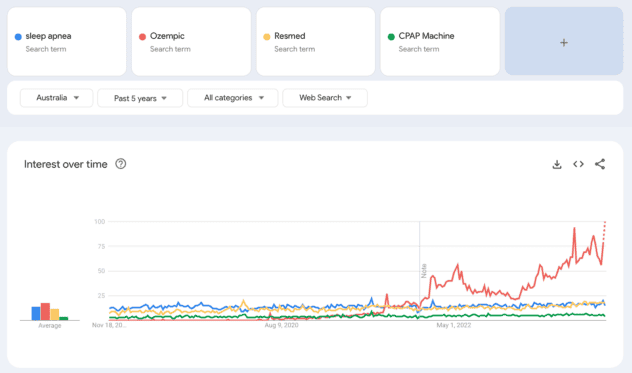

Not long ago, ResMed traded on a P/E ratio of 40 to 50 times earnings. As Ozempic has become popular (shown above), investor fears have grown of the drug's perceived role in reducing sleep apnea. However, ResMed and sleep apnea are yet to show marked impacts from this.

Why I see a potentially fruitful investment

The sleep apnea industry is vast. Some 936 million adults around the world are estimated to have mild to severe obstructive sleep apnea, according to The National Council of Aging. ResMed has only scratched the surface, with approximately 22.5 million connected devices sold to date in 2023.

Furthermore, demand for treating sleep apnea is still forecast to grow to 1.2 billion people worldwide by 2050, even when assuming a 15% reduction due to weight-loss drugs.

These figures are based on ResMed's own internal studies, so make of that what you will. Though, I personally believe it could be roughly accurate. It's hard to imagine these 'wonder drugs' will suit everyone, potentially giving ResMed more room to grow than many investors are factoring in.

As such, I'm primed and ready to scoop up more of this ASX 200 share at my next available opportunity.