All Ords stock Catapult Group International Ltd (ASX: CAT) is trading 6.1% higher at 99 cents after the company released its 1H FY24 results today.

The All Ords sports tech stock is having a great run in 2023, up 33.4% in the year to date. That's well above its S&P/ASX 200 Information Technology (ASX: XIJ) peers, with the index up 18.3%.

Let's dig into the report.

Cost discipline and sales growth lead to positive cash flow

Catapult delivers sports technology solutions for professional teams.

For the half year ended September 30, the highlights were:

- Annualised contract value (ACV) of US$79.7 million, up 21% year-over-year (yoy) on a constant currency basis

- Revenue increased to US$49.8 million, up 21% yoy

- ACV churn fell to 3.6%

- Incremental profit margin of 19%

- Positive free cash flow (FCF) of US$1.4 million, up from a deficit of (US$13.4 million) in 1H FY23

- US$4.7 million of debt repaid.

What else happened in 1H FY24?

Catapult said disciplined cost management and sales growth enabled the company to deliver a financial "milestone" in 1H FY24 with the first positive cash flow since 1H FY21.

The company reduced its debt to US$11 million during the half, and CFO Bob Cruickshank said recent investments and the scaling up of the business had produced a "very encouraging" 1H result.

Cruickshank said:

The growth of our SaaS revenue highlights the strength of our core verticals, and disciplined cost management has enabled us to return to positive free cash flow generation.

The significant improvement in our incremental profit margin, the result of a very focused approach to how we run our business, demonstrates that we are delivering on our strategy and ensuring we are well positioned for future growth.

What did Catapult management say?

Managing Director and CEO Will Lopes said the company's customer retention trends were at all-time highs. He said this was "an excellent outcome given we have been through our busiest renewal period".

He added:

We remain committed to generating positive free cash flow, strengthening our financial position further, and ensuring we can continue to drive future revenue growth.

What's next for this All Ords stock?

Commenting on the outlook, Lopes said:

We will continue to innovate, releasing new solutions in support of our products, helping teams make even better decisions with our technology.

In FY24 we continue to expect ACV Growth to remain strong with high retention rates, and to generate positive free cash flow for the full year without the need to raise equity capital.

We will remain focused on our go-to-market strategy, whilst maintaining a disciplined approach to our cost base, driving our contribution and incremental profit margins towards our long-term targets.

Catapult share price snapshot

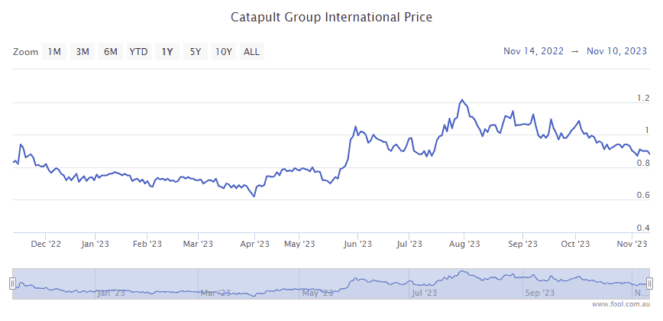

This All Ords stock has risen 23% over the past 12 months.

It has a market capitalisation of $236 million.