Does this ASX All Ords dividend stock really yield more than 11%?

That question was asked of me this morning by an investor friend on the hunt for some extra passive income.

The company in question is All Ordinaries Index (ASX: XAO) listed Liberty Financial Group Ltd (ASX: LFG).

Liberty Financial, if you're unfamiliar, is a diversified finance company operating in Australia and New Zealand. It offers a full array of home, personal, and business loans, as well as broking services, general insurance, and its investments business.

Liberty Financial began trading on the ASX on 15 December 2020.

While the early post-IPO months went well, the stock trended steadily lower from there through to late 2022, losing more than 57% of its value.

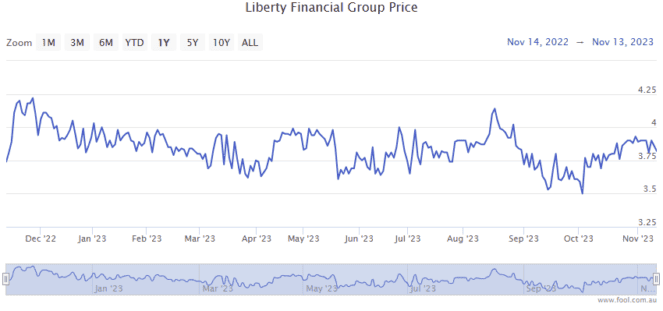

But the last 12 months have looked up for the ASX All Ords dividend stock, with the share price gaining 3.5% over the full year.

And, yes, the company is sought after for its dividends.

But does it really pay a yield north of 11%?

Let's find out.

Hunting for high-yielding ASX All Ords dividend stocks

Liberty Financial has paid two annual, unfranked dividends since listing on the ASX.

The company paid an interim dividend of 21 cents per share on 15 December. The final dividend of 24 cents per share landed in eligible investors' bank accounts on 31 August.

The final dividend was declared when the ASX All Ords stock reported its FY 2023 results, which included a $181 million statutory net profit after tax (NPAT).

And while down from FY 2022, the company's return on equity (ROE) of 15.3% remained high by industry standards.

"LFG again delivered the highest ROE to leverage ratio compared to its bank and non-bank peers," chief financial officer Peter Riedel said at the time of the results release.

All told then, the ASX All Ords dividend stock paid out a total of 45 cents per share over the past 12 months.

At the current share price of $3.90, that equates to a trailing yield of 11.5%.

Which, the last I checked, is indeed more than 11%!