Sometimes even S&P/ASX 200 Index (ASX: XJO) market darlings just can't make their share price budge upwards.

IDP Education Ltd (ASX: IEL) is a case in point.

The international student placement and English testing provider has had the adulation of the professional investors community the past couple of years.

The theory was that after COVID-19 stamped in with a sudden and rude interruption to business, IDP Education would bathe in earnings glory in the post-pandemic world.

Unfortunately it hasn't quite worked out that way.

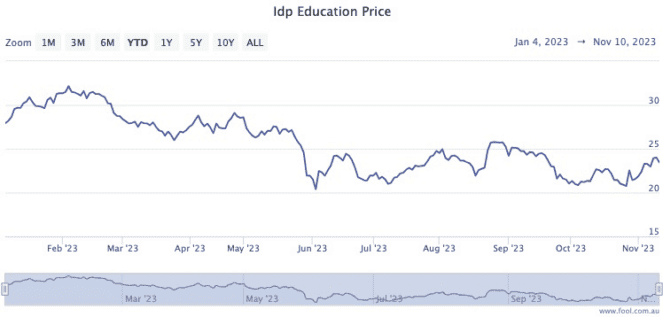

The shares are now trading about 40% lower than they did two years ago, and more than 27% under the peak in February this year.

So what's doing?

Upside to margin and earnings growth

If you ask Fairmont Equities managing director Michael Gable, IDP shares are a bargain waiting to be added to your portfolio.

He recently cited three possible catalysts that could put a rocket under the ASX 200 stock.

First factor is what the market has been expecting for years — a revival in international student placement volumes.

Secondly, there's the English testing (IELTS) business.

"A strong competitive position in IELTS, where pricing power remains," said Gable on the Fairmont blog.

"This provided upside to group margin as IELTS volumes recover towards the company's target growth rate of high single-digit over the medium term."

Thirdly, Gable feels like there is 12% to 18% upside to the market's earnings growth forecasts.

"This is due to the likelihood of IDP Education using its under-geared balance sheet position and/or re-investing free cash to pursue merger and acquisitions."

IDP Education's dominant position in its sector means it has superior pricing power.

"During FY23, average student placement fees increased +7%. This growth was driven by commission rate increases and higher tuition fees.

"The company noted improved conversion rates from the use of artificial intelligence and lead indicators remain at record highs, with leads +26%, applicants +40% and course enrolments +53%. These trends underpin the expectation for further pricing growth."

Gable's peers mostly agree with his bullishness.

CMC Markets currently shows nine out of 14 analysts that cover IDP Education rate the ASX 200 stock as a buy.