The Pro Medicus Ltd (ASX: PME) share price has spiked well above $86 in Monday trading amid investors hearing news of the company's latest contract win.

At the time of writing, the ASX healthcare share is trading at $86.66 a share, or 1.74% higher than Friday's closing price of $85.18. Earlier today, the Pro Medicus share price hit a high of $86.75.

The company been winning a steady stream of major contracts in the last couple of years and this eight-year deal is its latest success.

In October, Pro Medicus signed an A$16 million, eight-year deal with US company South Shore Health and in September, it signed an A$140 million, ten-year deal with Texas-based Baylor Scott & White.

Oregon contract win

Today, Pro Medicus announced it has won an A$20 million, eight-year contract with Oregon Health and Science University (OHSU), which it described as the preeminent academic medical centre in the US state of Oregon.

OHSU includes the OHSU Hospital and OHSU Doernbecher Children's Hospital, with a total of 576 licensed beds. Pro Medicus also said OHSU has a system of clinics across Oregon and southwest Washington state, with a total of nearly 20,000 staff.

This deal, as usual, is based on a transactional licensing model which will see Pro Medicus' cloud-engineering Visage 7 implemented throughout OHSU to provide a unified diagnostic imaging platform.

Pro Medicus also said Visage 7 will provide enterprise distribution of images integrated into OHSU's electronic health record (EHR).

Planning for the rollout will "commence immediately", with a go-live targeted for the fourth quarter of the 2024 calendar year.

CEO commentary

Pro Medicus CEO Dr Sam Hupert said:

OSHY adds to our rapidly growing list of clients in the Pacific Northwest. They also join a long list of Visage 7 clients to opt for a fully cloud-engineered solution, which, as a result of our CloudPACS strategy, is becoming the standard in the North American healthcare IT market.

Our pipeline remains strong and spans all market segments. As has been the case with many of our recent contracts, this dela is for our "full-stack" comprising all three Visage products namely viewer, workflow and archive, a trend we see continuing.

Pro Medicus share price snapshot

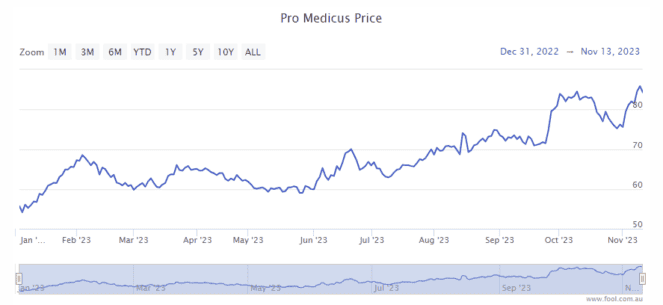

As we can see on the chart below, 2023 has been another very good year for the business.

A couple of months ago, Pro Medicus reported its FY23 full-year result which showed a 33.6% year-over-year increase in revenue to $124.9 million and a net profit of $60.6 million (up 36.6% year over year). The board decided on a full-year dividend of 30 cents per share, an increase of 36.4% compared to FY22.

Since the beginning of the year, Pro Medicus shares are up close to 60%.