Owners of ANZ Group Holdings Ltd (ASX: ANZ) shares will be getting a larger-than-expected dividend although there has been a surprise with the bank's franking credits.

ANZ just reported its 2023 full-year result, which included a more generous dividend than perhaps some investors were expecting. The bank's continuing operations cash profit went up 14% to $7.4 billion, while the cash profit before credit impairments and tax increased 20% to $10.75 billion.

ANZ dividend declared

The board of ANZ decided to declare a final dividend for FY23 of 94 cents per share franked at 56%. That included an 81 cents per share dividend partially franked at 65% (not 100%) and an additional one-off unfranked dividend of 13 cents per share.

ANZ explained that the level of franking reflects the geographically diverse nature of its operations, as well as the timing of its proposed acquisition of the banking segment of Suncorp Group Ltd (ASX: SUN).

The bank's board acknowledged the level of franking was lower than what some shareholders may have been anticipating. That's why the board decided the additional unfranked dividend was "appropriate".

This proposed dividend brought the full-year dividend to $1.75 per share, which was 20% higher than the FY22 payment. The full-year dividend represents a dividend payout ratio of 70.8% of continuing operations cash earnings per share (EPS).

At the current ANZ share price, the proposed 94 cents per share dividend represents a partially franked dividend yield of 3.8%.

Payout timetable

An ex-dividend date is the day prospective investors would miss out on the upcoming dividend payment. If someone wants to receive the dividend, they need to own shares by the end of the last trading day before the ex-dividend date.

ANZ shares have an ex-dividend date of 16 November 2023. This means investors need to own shares by the end of trading on 15 November 2023, which is Wednesday – only two days away.

The payment date for the 94 cents per share dividend is 22 December 2023, so the ANZ dividend is an early Christmas present.

ANZ share price snapshot

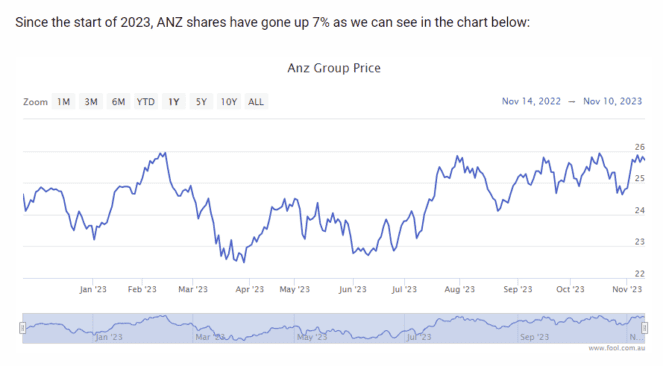

Since the start of 2023, ANZ shares have gone up 7% as we can see in the chart below: