The Zip Co Ltd (ASX: ZIP) share price is heading south today following the company's annual general meeting (AGM).

As we make a beeline for the closing bell, shares in the buy now, pay later (BNPL) provider are down 3.8% to 38 cents apiece. Meanwhile, the S&P/ASX 200 Index (ASX: XJO) is 0.23% greener than yesterday, predominantly boosted by the healthcare and consumer discretionary sectors.

It appears investors are not satisfied with Zip's AGM this morning. The unprofitable company ranked within the top worst-performing shares inside the All Ordinaries Index (ASX: XAO) on Thursday.

Let's try to drill down into what may have prompted the negative response.

What went down at the AGM?

Zip kicked off its 2023 AGM today at 10am. The prepared remarks of Zip managing director and CEO Cynthia Scott were upbeat, touting that Zip achieved positive cash earnings before taxes, depreciation, and amortisation (EBTDA) in the first quarter of FY2024.

Reflecting on the past financial year, Scott detailed several key measures taken during the period to position the business more strongly. These included Zip's efforts to improve margins, lower its cost base, and de-leverage its balance sheet.

The CEO highlighted improved expectations to achieve positive cash EBTDA in the current financial year (FY24). This enhancement in forecast earnings was driven by "the performance of the ANZ business, further momentum in US TTV [total transaction volume], ongoing margin expansion and continued cost discipline."

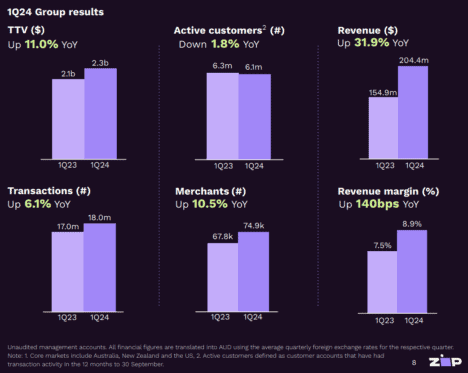

Zip has already demonstrated its ability to drive TTV growth and margin expansion in the first quarter. As depicted in the AGM presentation, the BNPL player increased revenue by 31.9% despite TTV growing a lesser 11% year-on-year. This illustrates the positive impact of Zip's focus on reducing costs.

Commenting on the outlook, Zip's CEO said, "Building on our strong momentum in the Americas, the expansion of our financial services offering in Australia and our strengthened balance sheet, we are well-placed to capture our future growth opportunity."

Why is the Zip share price falling?

Based on the above information, it is difficult to comprehend the reaction to the Zip share price today.

Realistically, we can only speculate on why the proceedings may have left a bad taste in shareholders' mouths. One possible reason could relate to Zip's complete lack of mentioning net profits… earnings after interest, taxes, depreciation, and amortisation.

Sentiment tends to drive a share price in the short term. However, profits that can be banked (or paid out in dividends) determine the share price in the long run.

Some shareholders could be growing tired of Zip's lack of net profits after tax (NPAT). In FY23, the payment solutions company posted an NPAT loss of $385.9 million on $693.2 million in revenue.