If you're looking to spend more time living and less time working, ASX passive income shares could tip your work-life balance in the right direction.

It's no surprise sustainable passive income was the number one goal of Australian investors of all ages in 2023, according to an ASX survey.

With that in mind, we asked our Motley Fool contributors to name their top ASX dividend shares to invest in right now. Here is what the team came up with:

6 best ASX dividend shares for November 2023 (smallest to largest)

- Plato Income Maximiser Ltd (ASX: PL8), $755.08 million

- Accent Group Ltd (ASX: AX1) $1.11 billion

- NIB Holdings Limited (ASX: NHF), $3.55 billion

- GQG Partners Inc (ASX: GQG), $4.06 billion

- AGL Energy Limited (ASX: AGL), $7.06 billion

- National Australia Bank Ltd (ASX: NAB), $91.8 billion

(Market capitalisations as of 7 November 2023).

Why our Foolish writers love these ASX passive income stocks

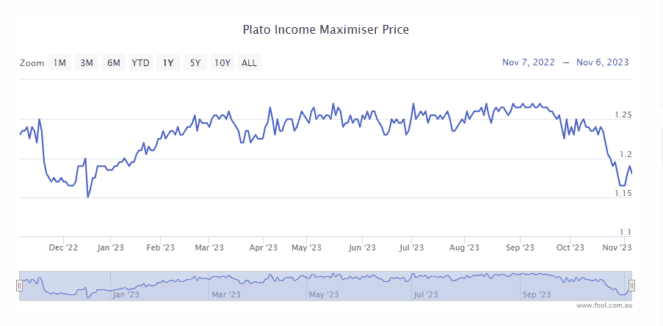

Plato Income Maximiser Ltd

What it does: Plato Income Maximiser is a listed investment company (LIC) that aims to provide investors with a consistent and high level of fully franked dividends on a monthly basis.

By Sebastian Bowen: Plato Income Maximiser is a passive income-focused investment that I've recently purchased and still believe is looking cheap this November. It's an LIC that owns an underlying portfolio of dividend heavyweights. These include BHP Group Ltd (ASX: BHP), Woodside Energy Group Ltd (ASX: WDS), and Ampol Ltd (ASX: ALD).

There are many shares that tilt towards providing hefty dividend income on the ASX. But I think Plato stands out for its monthly dividend policy, as well as its demonstrated ability to outperform the S&P/ASX 200 Index (ASX: XJO) over time. Since its inception in 2017, shareholders have enjoyed a total shareholder return (share price growth plus dividends) of 8.7% per annum, handily outperforming its ASX 200 benchmark.

I was happy to recently buy this income stock, and I think it's still well worth a look this month.

Motley Fool contributor Sebastian Bowen owns shares of Plato Income Maximiser Ltd.

Accent Group Ltd

What it does: Accent is a footwear-focused retailer with a growing stable of retail brands. This includes The Athlete's Foot, HypeDC, Platypus, and Style Runner. In addition, the company has expanded into fashion retail through the acquisition of Glue Store and Nude Lucy.

By James Mickleboro: While Accent's shares have rebounded strongly from their lows, they are still trading well short of their 52-week high and at just 13 times estimated FY 2024 earnings, according to Bell Potter's estimates.

I think this is cheap given its strong long-term growth potential, which is being underpinned by the popularity of its brands and store expansion plans. In addition, with Bell Potter forecasting fully franked dividend yields of 6.1% in FY 2024 and 7.1% in FY 2025, it could prove to be a great passive income stock.

The broker also sees plenty of upside for its shares with its buy rating and $2.50 price target.

Motley Fool contributor James Mickleboro does not own shares of Accent Group Ltd.

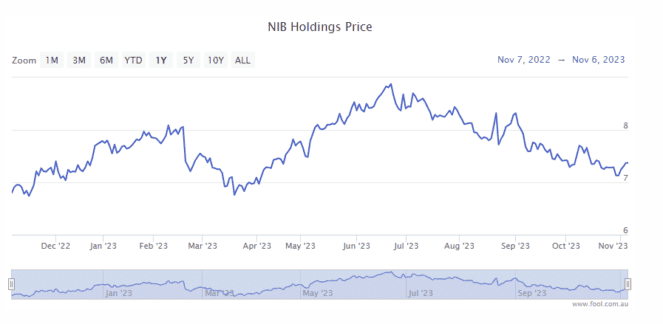

NIB Holdings Limited

What it does: NIB provides health insurance to more than one million members across Australia and New Zealand. In addition, the company is active in supplying coverage to inbound international workers and outbound overseas travellers. In recent years, NIB has built a meaningful business in National Disability Insurance Scheme (NDIS) plan management.

By Mitchell Lawler: I believe private health insurers are beneficiaries of a struggling public healthcare system.

Private coverage holders have surged post-pandemic. Many have decided health insurance is an expense worth forking out for amid lengthening wait times and reduced bulk-billing.

NIB has successfully grown alongside fellow insurer Medibank Private Ltd (ASX: MPL) to date. In FY23, NIB increased its revenue by 10.9% to $3.1 billion while upping its net profits by 42.8% to $191 million.

The combination of a strong structural tailwind, long-tenured management, and a growing brand, NIB appears well-situated to reward a patient investor. Based on the current share price, this ASX company delivers a 3.8% yield.

Motley Fool contributor Mitchell Lawler does not own shares of NIB Holdings Limited.

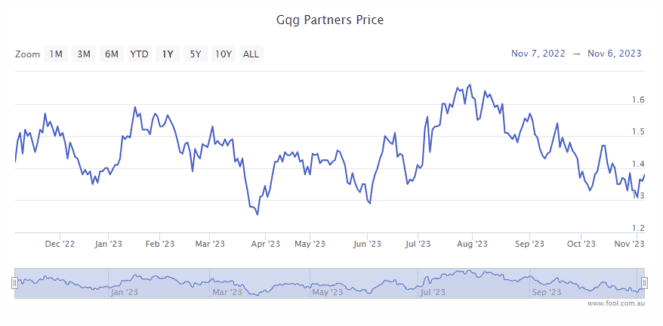

GQG Partners Inc

What it does: GQG Partners is a fund manager headquartered in the US. It offers a number of funds focused on different strategies including international shares, US shares, emerging markets, and dividend shares.

By Tristan Harrison: GQG shares are trading close to their 52-week low, yet the company's funds under management (FUM) performance continues to be strong. In the nine months to September 2023, the company has seen net inflows of US$8.1 billion and its FUM reached US$105.8 billion. That FUM (in US dollars) is worth considerably more in Australian dollar terms considering how much the AUD has weakened this year.

Thankfully, the company's investment funds have delivered solid long-term outperformance against their respective benchmarks.

According to projections on Commsec, the business could pay a dividend yield of 11.5% in FY24. Its dividend payout ratio policy is 90% of distributable earnings, meaning the ASX dividend share may be trading at under eight times FY24's forecast distributable earnings.

Motley Fool contributor Tristan Harrison does not own shares of GQG Partners Inc.

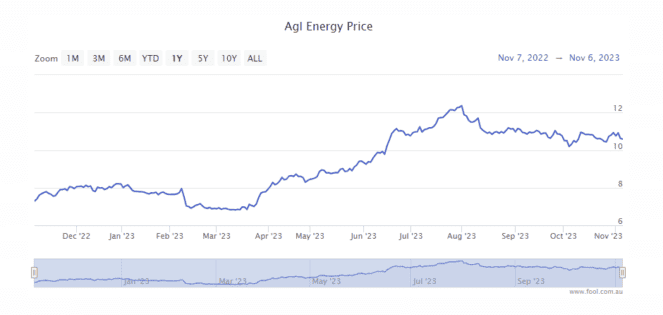

AGL Energy Limited

What it does: One of Australia's oldest energy providers, AGL operates in the gas and electricity wholesale and retail markets. The company's portfolio includes traditional thermal power generation as well as renewable sources, including hydro, wind, solar, and landfill gas.

By Bernd Struben: After struggling for two years amid post-COVID market difficulties and infighting over the company's ultimate strategy, AGL shares have come roaring back in 2023. Shares are up 49% in a year, alongside a rising final dividend payout. That's a trend I like to see.

And with utilities tending to outperform when consumers tighten their discretionary spending, AGL looks like a good passive income buy in today's economy.

Over the past 12 months, AGL has paid 31 cents per share in unfranked dividends, equating to a trailing yield of 3%.

Motley Fool contributor Bernd Struben does not own shares of AGL Energy Limited.

National Australia Bank Ltd

What it does: NAB is one of Australia's big four banks in terms of market capitalisation, earnings, and customer numbers. Its key differentiator is its strong focus on business banking, in addition to home mortgage lending.

By Bronwyn Allen: We recently compared the forecast FY24 dividends of ASX bank shares vs. mining shares to see which would pay more passive income in FY24. Bank stocks won, with NAB expected to pay $1.68 per share.

The NAB share price closed on Tuesday at $29.04, so that means a forecast yield of 5.8% fully franked. That's 2% higher than the typical yield of ASX 200 stocks. It also beats the best savings accounts today.

And it's higher than the net rental yields being achieved in Australia's booming property rental market. On a $10,000 parcel of NAB shares, you're looking at just under $600 in annual passive income.

Motley Fool contributor Bronwyn Allen does not own shares of National Australia Bank Ltd.