Australian prime minister Anthony Albanese is currently on a long-awaited tour of China to mend the relationship between the two nations.

He shook hands with Chinese president Xi Jinping on Monday night as the latter promised to improve rapport with Australia after years of enmity.

Xi even made a joke about Hollywood film Kung Fu Panda, which political commentators interpreted as a sign of success for the meeting.

So that's great that Australia is back in the good books with its largest trading partner.

Investors could now be wondering which is the best ASX stock that could take advantage of this new warm and fuzzy feeling.

What happened with Australia and China?

The Australia-China relationship deteriorated with the previous Australian federal government, especially in 2020 after it called for an independent enquiry into the origins of COVID-19.

Beijing retaliated with economically coercive measures, namely slapping massive tariffs on certain imports coming from Australia.

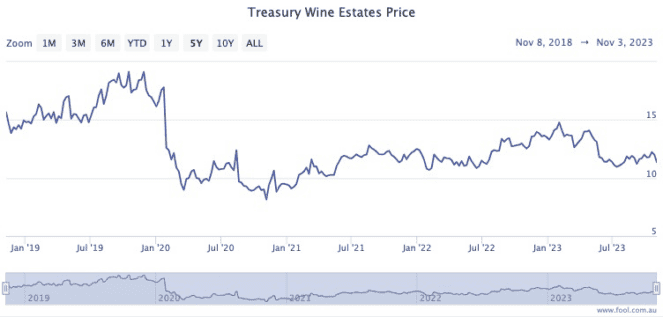

One of the big losers, if not the biggest, from that time was Treasury Wine Estates Ltd (ASX: TWE).

The company was selling wines like hotcakes to a massive Chinese middle class looking for imported luxuries.

Then overnight a huge tax was levied on Australian wine imports, and that market almost completely disappeared.

You can even see how that happened in August 2020 by spotting the painful dip in the Treasury Wine share price graph.

Perhaps the catalyst this ASX stock needed

This is why Shaw and Partners portfolio manager James Gerrish is tipping Treasury Wine shares to push higher over the medium term.

"Treasury Wine closed up 4.3% on Monday as the feedback from prime minister Albanese's visit to China became increasingly encouraging," he said to Market Matters subscribers.

Despite the warming relations between the countries, the Treasury stock price had stalled because of its capital raise to fund its huge $1.6 billion takeover of US winemaker Daou.

Now the diplomatic visit might finally give it the push it needs.

"China has offered to negotiate the removal of its tariffs on imports of Australian wine, which is great news for Treasury Wine looking forward."

The Treasury Wine share price closed Tuesday at $11.46.

Existing shareholders have a chance to buy more stock at $10.80 through the capital raise.

"We remain bullish on Treasury Wine with an initial target of $14, or +20% higher."