The ASX financial share Insignia Financial Ltd (ASX: IFL) could be incredibly cheap according to a fund manager from Ellerston Capital.

For readers who don't know what this business does, it's a significant player in the retirement and asset management space.

It has three main segments, the first is that it offers platforms for advisers, their clients and hundreds of employers in Australia. Second, it provides financial advice through its large network of financial advisers. Third, it offers asset management products that are designed for an investor's needs.

Is the ASX financial share cheap?

According to reporting by the Australian Financial Review, fund manager Chris Kourtis from Ellerston Capital believes that Insignia Financial is "one of the cheapest financials in the world." Kourtis said he would go "blue in the face buying that stock every day."

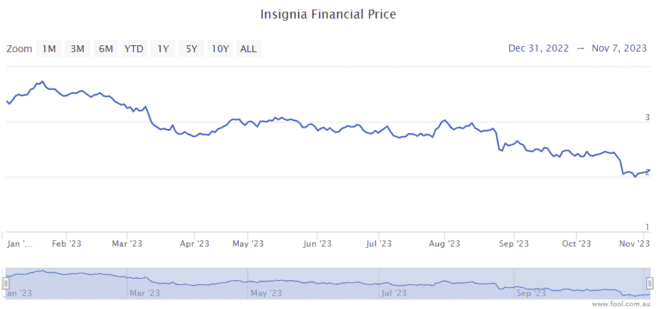

The ASX financial share has fallen over 33% in 2023 to date, as we can see on the chart below. It's also down by more than 25% from 23 August 2023.

It was recently announced that Insignia Financial's CEO Renato Mota will leave the business in February. When the boss leaves it can be a bit destabilising for a business – will the business continue its strategy and performance?

How is the company performing?

Insignia Financial recently gave its quarterly update for the three months to September 2023 as it makes "strong early progress on achieving its FY24 to FY26 strategic initiatives to strengthen and simplify the business, reduce costs, and improve growth momentum."

In terms of the cost optimisation program, the business says it's delivering benefits. It's on track to realise $60 million to $70 million this financial year and $175 million to $190 million of gross annualised benefits over FY24 to FY26.

However, in the latest quarter, it saw net outflows of $1.4 billion, which was mainly down to platform net outflows of $1.3 billion, which was largely due to MLC Wrap ahead of the migration.

Funds under management and administration (FUMA) reduced by $1.9 billion (a reduction of 0.6%) to $293.1 billion as at 30 September 2023.

How far could the ASX financial share rise?

Fund manager Kourtis suggested that the business should be trading at $5 rather than just over $2 like it is right now. That means the Insignia Financial share could rise by over 120%.

He said:

We're long and wrong at the moment, but I'll stand by my statement: that is a cheap stock.

The company has borne the pain, and it's now time to milk the cow, but the market is not rewarding because it's had negative momentum.

I'm all about buying the long and not having the time horizon of a gnat, which is what the market has currently.

There's always day traders running amok, but I'm taking a 30-year view. I think a lot of these guys take a 30-second view.