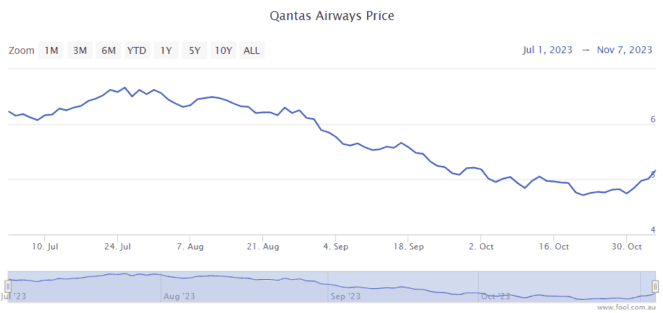

It has been an incredibly volatile 12 months for the Qantas Airways Limited (ASX: QAN) share price, as we can see on the chart below.

But, of course, past performance is not a reliable indicator of future performance. As we can see on the chart, just because Qantas shares have been falling doesn't mean they're going to keep falling forever.

By the same token, the recent bounce of the Qantas share price doesn't mean it's going to keep rising either.

What's the problem?

The ASX travel share is facing myriad issues. These include higher oil prices, ACCC legal action, the High Court loss over the company's illegal sacking of employees, a major reputation hit, and an uncertain outlook for demand.

I'm no legal expert so I can't preempt how the ACCC case is going to end up, but it could certainly be problematic for Qantas if it loses.

Safe to say, the company's alleged — and well-publicised — missteps certainly won't have won it more customers.

The COVID-19 period was a tough time for ASX travel shares generally, particularly airlines. Qantas had a difficult time and took steps it thought would help. Some of those actions have since come under the spotlight.

Broker UBS points out the ASX travel share will incur an additional $80 million in FY24 expenses on initiatives addressing sources of recent customer frustration.

These could include additional seats available for points redemption, improved catering, improved call centre support, and more generous policies to help customers through service disruptions.

UBS expects half of those costs will be recurring in nature. But it also believes Qantas could lower the impact of them by improving its reliability.

The broker also pointed out Qantas has estimated its FY24 first half could see a fuel expense that's $200 million higher than initial guidance in August, while other costs could be $50 million higher due to a weaker Australian dollar.

Qantas may also need to spend a lot of money on renewing its ageing aircraft fleet in the coming years.

With all this going on, perhaps it's no surprise the Qantas share price is down more than 20% from July 2023.

Why Qantas shares could be an opportunity

The Qantas leadership spent a lot of time apologising at its annual general meeting (AGM), but the company also made a couple of comments about trading conditions.

The ASX travel share revealed "travel demand continues to be strong" and its balance sheet is in "excellent condition". Qantas also noted its fleet renewal is underway and that the new aircraft will help it meet sustainability targets and open up more network options.

While Qantas has been under fire, the airline is saying it's still seeing strong demand. That means its profit may not be taking much of a hit, particularly if it passes on higher costs to passengers in the form of higher airfares.

Over the longer term, a company is usually judged by its profitability and it is possible the market may have gone overboard on the negativity.

UBS thinks Qantas is a buy and that the company could generate around $1.6 billion of net profit in FY24. It tips its earnings per share (EPS) could be very similar, though slightly lower in the 2024 financial year.

The current Qantas share price is trading at under six times UBS's estimated earnings for FY24.

UBS thinks Qantas shares are a buy with a price target of $8, suggesting a rise of just over 50% in 12 months if the broker is on target. I also think the Qantas share price is undervalued, although I don't think it is undervalued as much as UBS thinks it is.