The S&P/ASX 200 Index (ASX: XJO) share Pinnacle Investment Management Group Ltd (ASX: PNI) is the latest company I've added to my portfolio.

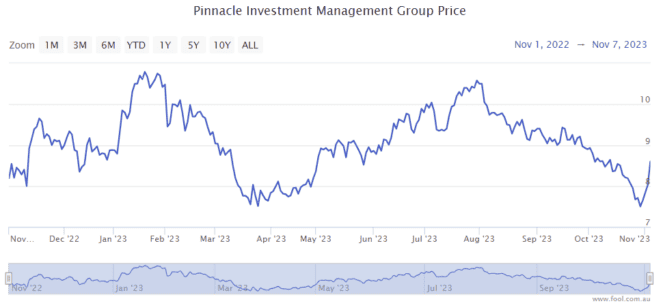

As we can see on the chart below, the Pinnacle share price is down 21% from 1 August 2023. It's also down by around 55% from November 2021. It's no understatement to say its shares are much cheaper than they used to be.

That said, I wouldn't invest in something just because its share price has fallen. I'd call Pinnacle a high-quality ASX 200 share that ticks all the boxes of what I'm looking for. That's why I decided to invest $3,000 at $7.72 per share.

For readers who aren't sure what this company does, Pinnacle aims to identify and work with quality fund managers who want to set up their own investment businesses. Pinnacle takes a stake in new businesses and helps them grow with seed funding, global institutional and retail distribution, and "industrial grade" middle office and infrastructure services.

The idea is that Pinnacle takes care of much of the non-investing stuff so the fund managers can focus on the investing side of things.

Underlying growth makes the ASX 200 share's valuation look cheap

If a company is delivering operational growth then the lower share price almost certainly improves the value on offer.

I've already mentioned the Pinnacle share price has seen a 20% decline in just three months.

In the six months to 30 June 2023, the company saw aggregate affiliate funds under management (FUM) increase by 10% to $91.6 billion, with net inflows over the next months of $3.1 billion including $0.6 billion from retail investors.

It managed to achieve those inflows despite the current uncertainty and volatility in markets, which could have discouraged investors from allocating money to these fund managers.

While it's Pinnacle's share price decline that attracts me most to the company, the price/earnings (P/E) ratio also looks appealing considering its prospective growth.

According to the projections on Commsec, the Pinnacle share price is valued at under 22 times FY24's estimated earnings and 18 times FY25's estimated earnings.

Growth can come in a variety of different ways. Fund managers can keep experiencing inflows for their existing funds, they can start new funds, or enter new strategies. All the while, Pinnacle is adding to its portfolio of investments. Indeed, one of its newest sign-ons is a Canadian-based funds manager.

Dividend

My investment in Pinnacle shares has gone well in these early days. I don't know when (or if) the share price will climb above $10.50 again, though I hope it does. I mention $10.50 because it's close to highs at the start of August and, earlier, in January. Whilst I'm waiting for good capital growth, I can receive a good dividend.

The ASX 200 share has been paying a dividend since 2016. It has grown its dividend every year aside from FY20 (amid the onset of COVID) when it prudently maintained its dividend.

Using the payout from FY23, Pinnacle has a trailing grossed-up dividend yield of 6.1%.