ASX healthcare share Australian Clinical Labs Ltd (ASX: ACL) has seen a large sell-off this year. So is this an opportunity to buy the dip?

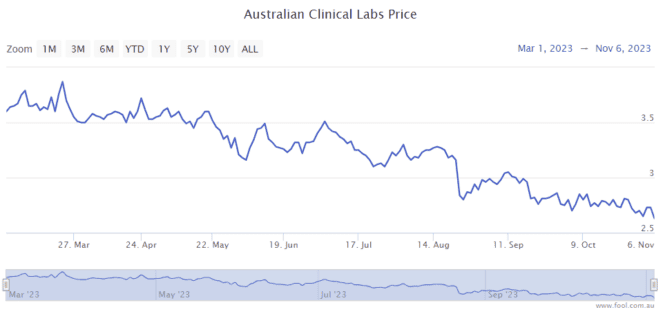

As we can see on the chart below, since March 2023, the Australian Clinical Labs share price has shed around 30%. The S&P/ASX 200 Index (ASX: XJO) has dropped approximately 5% over the same time period.

What's going on with the ASX healthcare share?

There are a number of things that aren't quite going to plan for the pathology company.

In FY23, ACL saw its non-COVID revenue sink by $362 million, leading to total patient revenue declining by around $300 million. FY23 earnings before interest and tax (EBIT) fell $264 million and net profit after tax (NPAT) declined $142 million to $35.9 million.

The company can't help the loss of its COVID-19 testing revenue. Indeed, it's a good thing that Australians, collectively, don't need to test as much as they did during the peak COVID period.

However, the company said its non-COVID revenue hadn't fully recovered "to trend" following the pandemic.

The ASX healthcare share estimated there was at least $50 million of latent revenue opportunity for the company if the market had performed on trend in FY23. Volume is expected to return in key areas where there had been underperformance, including private hospitals, clinical trials, and GP referrals.

The company is also trying to acquire Healius Ltd (ASX: HLS). The combining of the companies would create Australia's largest pathology provider. However, the deal is subject to ACCC and FIRB approval.

Australian Clinical Labs is currently waiting on word from the regulators, though the Healius board doesn't seem keen on the current offer. It may be that ACL could be wasting its time and money pursuing the acquisition if it doesn't happen.

Finally, ACL recently announced it is facing civil proceedings brought by the Australian Information Commissioner. It follows a cyber incident relating to the personal information of some patients and staff through the company's Medlab segment.

Are Australian Clinical Labs shares an opportunity?

When times are worrying for a business, it can be the best time to go hunting for its shares.

However, with the fall in COVID-19 revenue, Australian Clinical Labs is likely to achieve a similar EBIT result in FY24 of between $65 million to $70 million. However, it's expecting to end FY24 at a higher run rate, which could mean solid EBIT growth in FY25.

In FY24, the company wants to capture above-market growth in revenue thanks to new collection centres, new test initiatives, and the return of volume in key referral channels.

It also wants to work on reducing costs and deliver operational efficiencies to help offset supplier and wage pressures.

According to the estimate on Commsec, the business is projected to be trading at 14 times FY24's estimated earnings and could pay a grossed-up dividend yield of 6.2%.

I think the ASX healthcare share is now at a very reasonable valuation considering it's in the defensive sector of healthcare pathology.

Remember that non-COVID revenue increased by 11.3% to $619.5 million, so the underlying business is performing well.

In FY25, it could generate 22.9 cents of earnings per share (EPS) and pay an annual dividend per share of 13.9 cents. This would put the current Australian Clinical Labs share price at under 12 times FY25's estimated earnings with a grossed-up dividend yield of 7.5%.

While I don't think Australian Clinical Labs is going to shoot the lights out, I think it's a good company at an attractive price. It can also benefit from useful tailwinds like Australia's growing population and ageing demographics.