Late last month, we saw one of the biggest events in ASX 200 gold stock history. The ASX 200 lost one of its stalwarts, and its largest constituent, in Newcrest Mining. But it also welcomed a new gold stock in Newmont Corporation (ASX: NEM).

As gold enthusiasts would be well aware, earlier this year Newcrest received a takeover offer from the giant US gold miner Newmont Corporation (NYSE: NEM).

After some toing and froing, Newcrest and its investors accepted an all-scrip acquisition bid from Newmont. Investors were to receive 0.4 Newmont shares for every Newcrest share owned. At the time this final offer was made, it valued Newcrest at $32.87 a share, which was a significant premium to the pricing that investors have seen with this company in recent years.

Well, fast forward to today, and the Newmont takeover is a done deal. Newcrest shares have left the ASX for good, ending a multi-decade presence on the Australian stock market.

However, Newmont is a US-listed company, which doesn't quite make for the easiest of ASX share mergers.

The new Newcrest: How the Newmont share price came to the ASX 200

To overcome this hurdle, Newcrest investors on the ASX received CHESS Depositary Interests (CDIs) in Newmont. CDIs are a financial instrument that allows a foreign-listed share to trade on the ASX. Put simply, a CDI represents ownership of its primary-listed equivalent. So in essence, one Newmont ASX CDI equates to one Newmont share on the US market, with the prices reflecting the difference in exchange rates of course.

As such, every Newcrest investor who didn't opt to sell their shares before the company delisted from the ASX now owns 0.4 Newmont CDIs for every Newcrest share they used to own. These new Newmont shares had their first day of ASX trading on Friday 27 October.

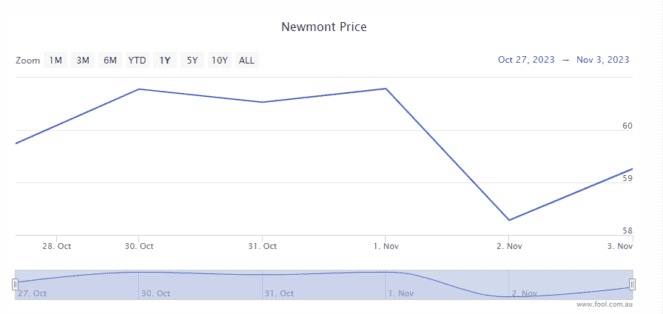

Let's now see how these Newmont shares have performed over their first week-and-a-bit of ASX life.

The Newmont share price closed at $59.50 on that Friday. By the subsequent Monday, the company had already inked a new high of $63.36. But as gold sentiment dropped over the last week, so too did Newmont CDIs. By last Thursday, the company had dropped to a low of $57.86 and closed the day at $58.25.

But last Friday and today have seen something of a recovery. Newmont shares gained 1.18% last Friday, and have added another healthy 1.9% so far this Monday. That leaves Newmont at $60.06 a share at the time of writing.

All in all, it's been a volatile — but positive — first week and a bit for Newmont shares:

Let's see how the rest of this US-listed gold miner's ASX life goes.