The ideal ASX share, I'm sure most investors would agree, is one that provides both steady capital growth over time as well as a rising and reliable stream of dividend income.

I'm sure most investors wouldn't buy a share if they knew its share price was destined to be stuck in the mud for two decades. Yet that's exactly what some famous ASX shares have given investors over the past 20 years.

How famous? Well, let's take a long-term view of the Westpac Banking Corp (ASX: WBC) share price for a moment. Westpac is the oldest public company in Australia and has been a stalwart of the S&P/ASX 200 Index (ASX: XJO) for decades. Today, it holds its place in the top echelons of the ASX, occupying the sixth-highest spot (by market capitalisation) on the ASX 200.

On Friday, Westpac shares closed at $21.50 each, up 1.56%. Yet the first time we saw Westpac hit this share price wasn't one year ago, nor five. It was back in late 2005, almost 17 years ago.

All show and no growth?

But surely this is an outlier from the other big four ASX banks? Well, no.

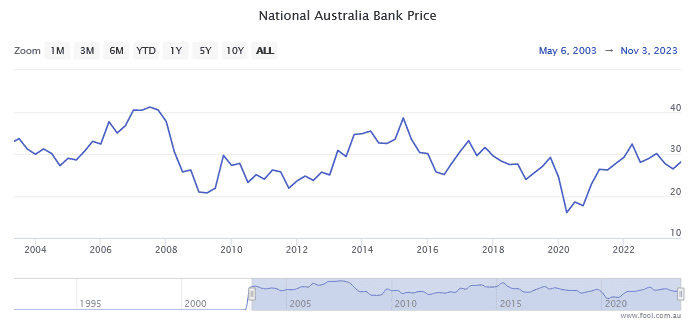

Take a close look at the National Australia Bank Ltd (ASX: NAB) share price over the past two decades:

Yep, NAB shares were actually more expensive back in 2003 than they are today. In fact, the first time NAB hit the $29 a share levels we see at present was way back in early 2001. Our records can't even show it on a graph.

Although not a bank, another popular share many ASX investors hold for income is listed investment company (LIC) WAM Capital Ltd (ASX: WAM).

On Friday, WAM Capital shares finished up at $1.54 each. Yet you could have bought those same shares for that same price back in early 2002.

Obviously, these kinds of capital growth returns aren't what most investors sign up for when they buy an ASX share. So they will have to rely on dividend payments alone to generate any kind of meaningful return.

Can dividend returns save these ASX laggards?

I've done some rough calculations, and come to the following conclusions for these three companies. Dividends (not including franking) have resulted in the following annualised returns over the past 20 years:

- Westpac – dividends have been worth approximately 6.47% per annum

- NAB – approximately 4.82% per annum

- WAM Capital – approximately 6.17% per annum

Anyone owning any of these three companies would have done better investing in a simple ASX index fund, such as the SPDR S&P/ASX 200 Fund (ASX: STW), which has averaged a return of 7.64% per annum since its inception in 2001.

Now, if you value meaningful dividend income (most retirees might fall into this category) and don't necessarily need to have capital growth, then owning these investments might suit you just fine.

Another scenario you could consider is that a company might be able to pull itself out of one of these 20-year funks. For example, I personally own NAB shares because I have faith in this bank's current management team. I am hoping (and expecting) NAB shares won't spend the next 20 years wallowing at the same valuation as today.

However, it just goes to show that even some of the ASX's bluest blue chip shares don't make for market-beating investments.