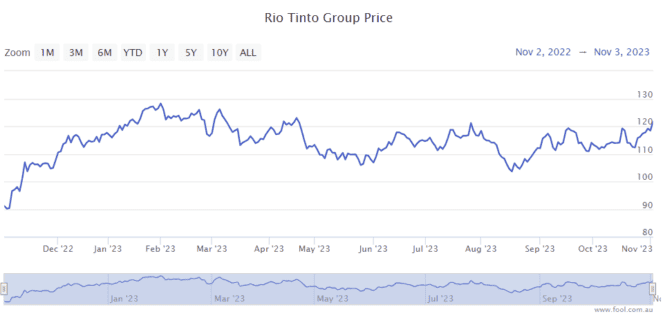

The Rio Tinto Ltd (ASX: RIO) share price has seen plenty of ups and downs over the last 12 months, as we can see on the chart below. Taking into account the latest market conditions, how are things looking for the company?

Rio Tinto is involved in a number of commodities including iron, copper, aluminium, lithium and bauxite.

With how important a commodity price is for generating profit for Rio Tinto shares, the performance and outlook are usually a key influence on the Rio Tinto share price. In my opinion, iron and copper are the two most important commodities for the business, so I'm going to focus on those two areas.

Outlook for iron and copper

The iron ore price is currently sitting at US$124 per tonne according to Trading Economics, which suggested that renewed stimulus measures from China have prompted an improved outlook for commodity demand.

The Chinese government recently announced that it would increase its budget deficit this year to issue an additional CNY 1 trillion in sovereign bonds. This money is, according to Trading Economics, reportedly targeted to spur manufacturing and infrastructure activity which could increase demand from steel producers.

The broker UBS suggests that the iron ore price is expected to stay in a range of between US$100 per tonne to US$130 per tonne over the next six months. This strength may prove to be supportive for the Rio Tinto share price.

In terms of copper, UBS has recently increased its long-term expectations for the copper price to US$4 per pound, up from US$3.50 per pound because its detailed analysis suggested that the current rate of capital expenditure deployment is "insufficient" to match "robust demand from the energy transition."

UBS said:

There is currently significant volatility in commodity prices driven by weak China economic data vs stimulus optimism. We expect more stimulus to limit the downside risk to China's economic growth/commodity demand but not drive an aggressive acceleration in demand due to the structural issues in the property sector (affordability, inventory). Iron ore is structurally challenged but prices are supported by higher costs while gold, lithium & high-quality coal will be higher for longer; base metals, in particular copper, have attractive medium-term fundamentals so we see near-term weakness as a buying opportunity.

What about production?

In the third quarter of 2023, it said that it shipped 83.9mt of iron (up 1% year over year), 828kt of aluminium (up 9% year over year) and 169kt of mined copper (up 5% year over year).

In 2023, Rio Tinto is expecting to achieve 322mt of Pilbara iron ore shipments, 55mt of bauxite production, 3mt of aluminium production and 521kt of mined copper.

UBS said that Rio Tinto is constructive on the long-term outlook for iron ore demand, expecting finished steel demand to grow by approximately 17.6% from 2022 levels to 2040, driven by India and southeast Asian (ASEAN) countries, with the belief that the market will be able to absorb extra supply from Simandou and an increase from Pilbara.

Rio Tinto share price snapshot

Since the start of 2023, Rio Tinto shares have climbed around 6%.