Westpac Banking Corp (ASX: WBC) shares are up 1.32%, in line with the broader market on Friday.

The Westpac share price is currently $21.45 amid the S&P/ASX 200 Index (ASX: XJO) rising 1.11%.

The ASX bank share has risen by about 5% this week.

News of a strategic acquisition on Wednesday gave Westpac shares an extra boost, leading to a five-day outperformance against its 'big four' rivals.

But Michael Gable of Fairmont Equities is less than impressed with the ASX bank share.

Westpac shares 'vulnerable to long-term downtrend'

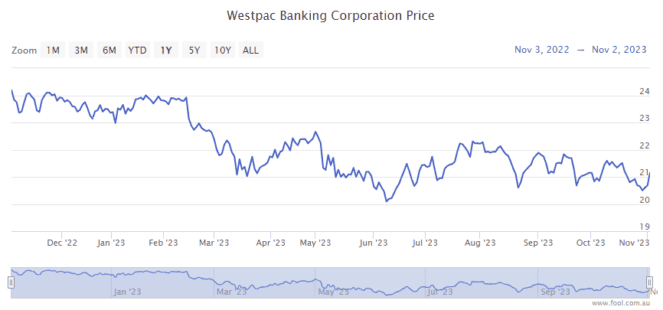

Gable notes that a recent rally in the Westpac share price failed to push it above its long-term trend line.

On The Bull, Gable commented:

WBC is the weakest of the major banks, in our view.

In terms of share price action, it recently rallied to below its long-term downtrend line before retreating again.

In our view, the stock is vulnerable to maintaining its long-term downtrend, particularly after the company soon declares its final dividend.

Westpac is set to declare that next dividend on Monday alongside its full-year FY23 results.

Top broker Goldman Sachs is tipping a final dividend of 70 cents per share.

As my Fool colleague James reports, Goldman is expecting Westpac to report cash earnings of $3,054 million for 2Q FY23. That would be 40% higher than 2Q FY22 but 25% lower than 1Q FY23.

It would also be 11.4% short of the consensus estimate of $3,446 million.

If Westpac does better than this, then its stock could experience a lift on Monday.