The Domino's Pizza Enterprises Ltd (ASX: DMP) share price went up more than 2% today in response to its trading update for FY24 which was delivered at the annual general meeting (AGM).

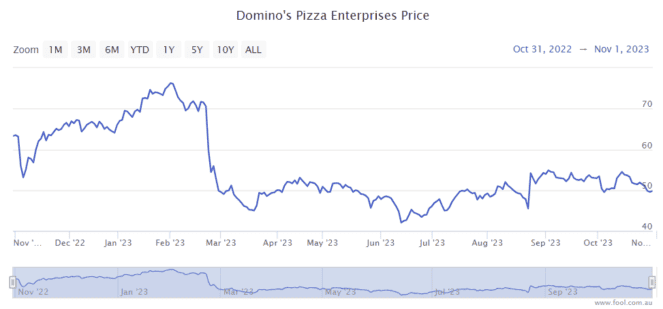

It has been a volatile 12 months for the company, as we can see on the chart below.

However, the first half of FY24 looks as though it's going to show a solid earnings recovery for the business.

FY24 trading update

Domino's noted that it lost some customers in FY23 who were focused on value. Those customers left because pricing changes, designed to offset inflation, "did not resonate" according to Domino's management. This may also have been a contributing factor that hurt the Domino's share price.

But, the pizza business has removed the delivery service fee, launched new products and linked up with Uber for a global partnership which is seeing it "serving even more customers".

In terms of revenue in the FY24 trading update, Domino's said that its network sales had grown by 12.7% year over year with same-store sales increasing by 2.7%. ANZ saw same-store sales growth of 7%, Europe's same-store sales growth was 3.8% and there was a 6.8% decline in Asian same-store sales.

Of Domino's 12 markets, 10 of them had positive same-store sales in the financial year to date. The two that didn't achieve same-store sales growth were Japan and Taiwan. France's sales, although positive, haven't yet achieved the same momentum as the other larger markets, so the company is focusing on this market.

The company disclosed that commodity pricing "continues to be challenging" due to global factors like war and climate change.

Despite elevated costs, the company is expecting earnings in the FY24 first-half result to be "materially higher" than the first half of FY23. Profitability is often a key driver of the Domino's share price.

The profit is expected to be "significantly higher" largely thanks to its strategic program to restructure the business. It said it will provide an update on the savings achieved through this program and the ongoing benefits in the FY24 half-year result, which is scheduled for February.

This restructuring program includes reducing the size of the corporate store network by closing underperforming stores and accelerating the refranchising of others. The ASX share is also reducing the number of Domino's staff in support offices and implementing shared services for some back-of-house functions.

Domino's said it's focused on rebuilding unit economics and franchisee partner profitability in FY24. The company said it's aiming to return to its store growth outlook in FY25.

Domino's share price snapshot

While Domino's shares are down 13% in the last 12 months, it's up 12% in FY24 to date (meaning since 30 June 2023).