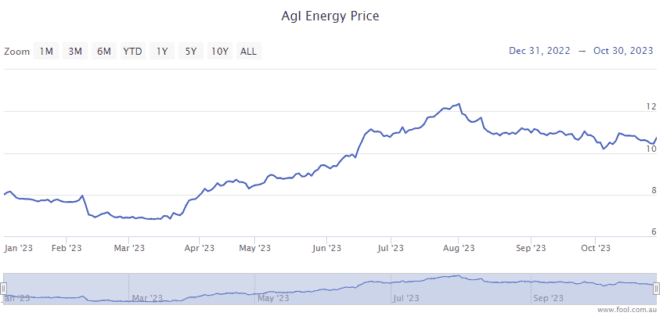

The AGL Energy Ltd (ASX: AGL) share price has fallen 12% from 1 August 2023. Despite that, the AGL share price is still up by around 34% since the start of 2023, as shown in the chart below. Should investors still be excited about the company?

The ASX energy share has seen a significant turnaround in profitability, driving a good rise in investor confidence in the company.

Latest outlook commentary

In its FY23 result, AGL maintained its underlying earnings guidance range.

Underlying earnings before interest, tax, depreciation and amortisation (EBITDA) could rise to between $1.875 billion and $2.175 billion. Underlying net profit after tax (NPAT) could double to $580 million at least and reach as much as $780 million.

There are two key reasons for the anticipated increase in AGL's earnings in FY24.

First, the company noted sustained periods of higher wholesale electricity pricing, reflected In "pricing outcomes and reset through contract positions."

The other key factor is that it's expecting improved plant availability and flexibility of the asset fleet, including the start of operations of the Torrens Island and Broken Hill batteries and the non-recurrence of forced outages and market volatility impacts from July 2022.

Can the profit and AGL share price rise beyond FY24?

Broker UBS likes the ASX energy share.

UBS suggests that energy prices could stay strong because of several factors. These include the potential exit of some/all of Origin Energy Ltd's (ASX: ORG) Eraring Power Station capacity in mid-2025, warmer weather associated with a forecast El Nino weather system and lower generation availability from competitors.

UBS is forecasting that earnings before interest and tax (EBIT) could rise by 8% in FY25 compared to its estimate for FY24, thanks to stronger electricity margins and a full year of additional capacity from the Rye Park wind farm.

The broker said that if AGL could continue to improve generation availability and "reliably maintain the flexibility now possible at Bayswater and Loy Yang power stations", it could provide "further upside" to UBS' outlook.

What is the AGL share price valuation?

Looking at the UBS estimate, it's projected to generate $1 of earnings per share (EPS) in FY24 and $1.12 in FY25.

If those projections are correct, it would put the AGL share price at 11x FY24's estimated earnings and under 10x FY25's.

UBS currently rates UBS as a buy, with a price target of $12.15. That implies a possible rise of 12% over the next year, though that's just the broker's guess.