ASX traders have been lining up to bet against the Flight Centre Travel Group Ltd (ASX: FLT) share price.

Every Monday, the Motley Fool publishes a list of the 10 most shorted ASX shares.

And shares in the S&P/ASX 200 Index (ASX: XJO) travel stock have been prevalent on that list throughout October.

On Monday, traders continued to bet that the Flight Centre share price was heading for a fall, with 9.5% of the stock held short. As Motley Fool contributor James Mickleboro noted on the day, "This could be due to concerns over the outlook of travel spending and revenue margin headwinds."

Other headwinds could arise from rising jet fuel prices.

Qantas Airways Ltd (ASX: QAN) recently flagged rising fuel costs would see the airline increase ticket prices, which could pressure travel demand.

Should we be betting against the Flight Centre share price?

If you'd taken a short position in the ASX 200 travel stock at the opening bell on Monday, you'd be sitting on a mounting loss today.

The Flight Centre share price is up 0.8% today and 3.6% so far this week. At the time of writing, shares are trading for $18.32 apiece.

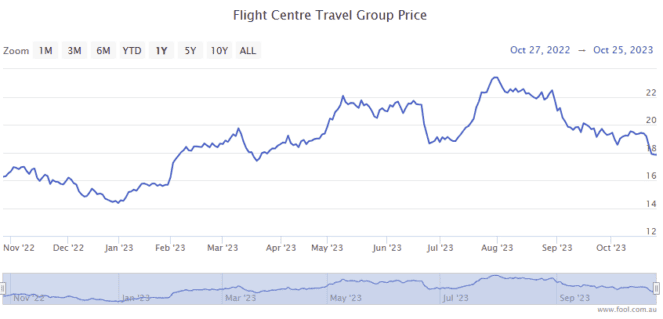

As for the past month, shares are down 5.7%. That's more than twice the 2.7% loss posted by the ASX 200 over this same period.

Year to date, Flight Centre shares remain up a very solid 27.5%.

So, do short sellers have it right? Or is the Flight Centre share price set to resume its rebound?

While only time will tell with certainty, I believe short sellers are taking a big risk betting against the travel company.

Despite a more challenging economic outlook, domestic and international travel demand remains resilient. And, alongside global air travel, the company is still in recovery mode following the lifting of COVID-19 border closures.

It's also worth noting that Flight Centre just paid its first dividend since 2019. While that payout was only 18 cents per share, my Foolish colleague Tristan Harrison recently noted that, "In FY24, the business is predicted to pay an annual dividend per share of 46.5 cents, and then this could rise to 70 cents in FY25."

Rising dividends tend to stem from rising profits. And I'd certainly think twice before betting against a company that's forecast to deliver rising profits.

As for some of the top brokers, Goldman Sachs has a neutral rating on the stock with a $21.50 target for the Flight Centre share price. That represents a 17% potential upside from current levels.

Short sellers, take note.