S&P/ASX 200 Index (ASX: XJO) gold stocks are shining bright again this month.

Most Aussie gold stocks have enjoyed a big lift over the past four trading weeks amid a sizeable uptick in the gold price.

On 27 September, the yellow metal was trading for US$1,900 per ounce. Today that same ounce is worth US$1,984, up 4.4% in a month.

As you'd expect, that's been a boon for gold producers.

And it's seen the S&P/ASX All Ordinaries Gold Index (ASX: XGD) – which also contains some smaller miners outside of ASX 200 gold stocks – gain 5.4% over four weeks of trading.

To put that in some context, the ASX 200 has lost 2.8% over that same period.

While you're unlikely to hear any shareholders complaining about a 5.4% monthly gain, these three leading gold shares have delivered more than double those gains.

ASX 200 gold stocks leading the charge

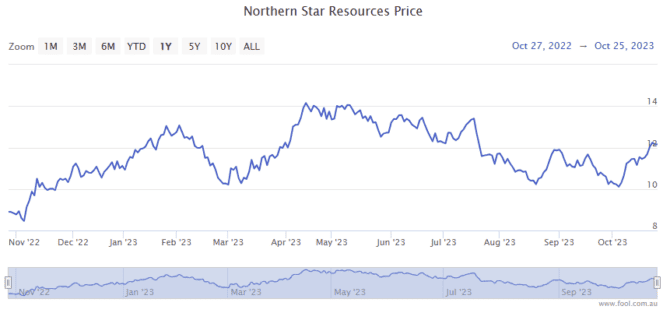

Northern Star Resources Ltd (ASX: NST) is one of the best performers on the ASX this month.

Since market close on 28 September, the ASX 200 gold stock has gained 13.6%. That's despite slipping 1.1% in intraday trade today.

Atop tailwinds from the rising gold price, Northern Star shares got a lift from the miner's quarterly update.

Northern Star reported total gold sales for the quarter of 369,000 ounces, achieving gold sales revenue of $1.04 billion. Investors appeared pleased that management reinforced expectations of increased second-half production.

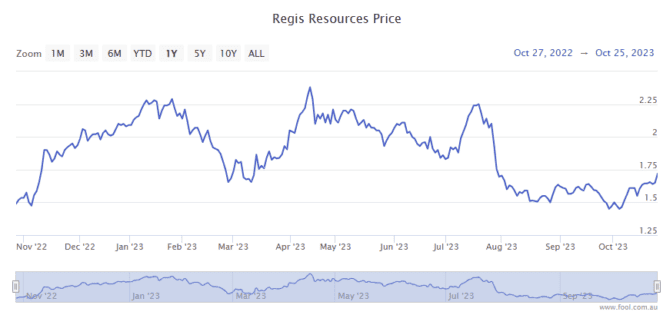

Which brings us to the second best performing ASX 200 gold stock over the past four weeks, Regis Resources Ltd (ASX: RRL).

The Regis Resources price is down 0.5% today but up an impressive 14.7% since this time last month.

Regis also released its quarterly update this month. The miner reported gold sales for the three months of 106,600 ounces for gold sales of $273 million.

Regis managing director Jim Beyer caught investors' attention when he noted:

With the closure of the hedge book now less than nine months away, it is crystal clear that the company's free cash flow generation in FY25 is set to accelerate, and we expect to deliver more than $170 million in additional pre-tax cash flow at current spot gold prices.

And the top performer

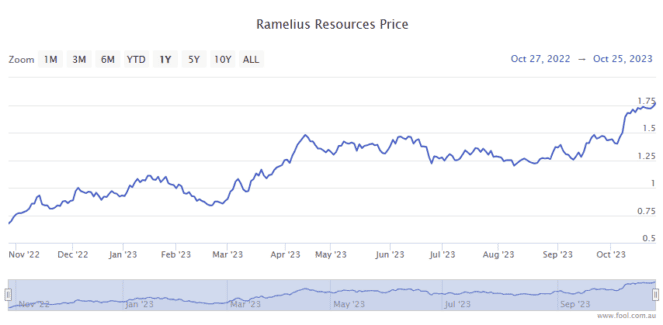

The best-performing ASX 200 gold stock over the last four weeks – and leading the charge higher on the benchmark index – is Ramelius Resources Ltd (ASX: RMS), up 17.8%.

There were no price-sensitive announcements from Ramelius over the month.

For its full FY 2023 results, the miner reported gold production of 240,996 ounces and a 5% year-on-year increase in revenue from ordinary activities of $631 million.

The ASX 200 gold stock has also likely benefited from its inclusion in the ASX 200 index on 18 September. That came as part of the S&P Dow Jones Indices quarterly review.