It's been a fantastic day for the Coles Group Ltd (ASX: COL) share price this Friday. At present, Coles shares are up a rosy 2.4% to $15.34 each, handily beating the S&P/ASX 200 Index (ASX: XJO), which is currently up 0.3%.

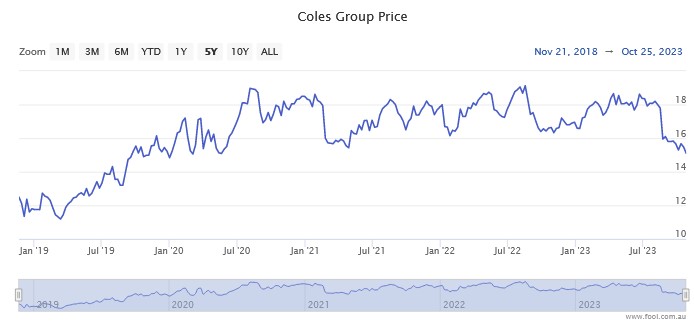

However, we can't ignore the fact that the Coles share price remains historically cheap, even after this big Friday bounce. After all, it was only yesterday that we saw Coles sales ink a new 2-week low of $14.82 a share.

Not only was that a new 52-week low, but it was also the lowest that this ASX 200 consumer staples share has plumbed in more than three years. You'd have to go back to the COVID-ravaged days of early 2020 to find the last time that the Coles share price had a '14' at the front of it. Check it out for yourself below:

So it looks as though Coles shares still remain exceptionally cheap, at least compared to their historical levels. After all, this company was going for over $19 a share as recently as August 2022.

But perhaps Coles is cheap for a reason. Yesterday's new 52-week low was prompted by a first-quarter update from the company, which made for some interesting reading. As we covered at the time, this update saw Coles report a 3.6% rise in group sales over the three months ending 24 September.

However, investors didn't seem impressed (hence the new 52-week low), given that Coles' arch-rival Woolworths Group Ltd (ASX: WOW) reported growth of 6.4% over the same period. As my Fool colleague James posited at the time, this "suggests potential market share losses".

Are Coles shares a cheap buy or damaged goods?

So perhaps investors might be wondering if Coles is a cheap buy and represents value as an investment today, or else is cheap for a reason.

Firstly, we discussed the investment thesis of Coles earlier this month. At the time, I posited that Coles is a quality company that can offer investors a defensive and fully-franked stream of dividend income. That remains my position today, considering the dividend yield for Coles shares now stands at an impressive 4.4%.

In my view, you could certainly do worse if you're looking for a reliable dividend payer for a passive income portfolio.

But earlier this week, my Fool colleague also discussed the current views of ASX broker Citi on Coles shares.

Citi has a buy rating on Coles right now, with a 12-month share price target of $18.30. If that were to become reality, it would see investors enjoy an upside of almost 20% from where the shares sit today.