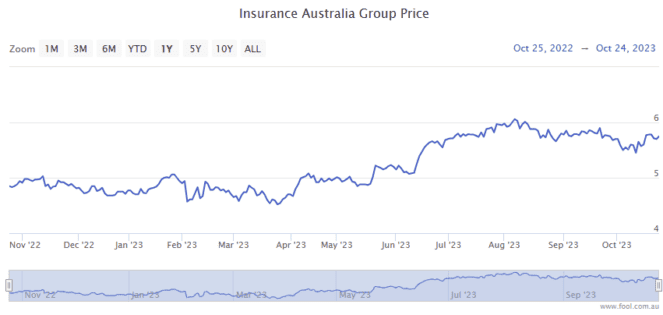

Insurance Australia Group Ltd (ASX: IAG) shares have been exceptionally strong performers over the past 12 months.

Since this time last year, shares in the S&PASX 200 Index (ASX: XJO) insurance company have gained 17%.

That compares to a far more meagre 1% gain posted by the ASX 200 over that same time.

And IAG shares also pay dividends, trading on a partly franked yield of 2.6%.

But even with those gains already in the bag, now could still be an opportune time to buy into the insurance stock.

Here's why.

IAG shares offer a means to protect revenue in risky, uncertain times

IAG shares could benefit from a number of global factors that tend to drag on most ASX 200 shares.

First, there's the worrying rise in global uncertainty and risk, underlined by the recent Hamas attack on Israel and mounting tensions across the Middle East.

You can add global cybercrime, Russia's ongoing war in Ukraine, and increased risks relating to climate change to the list of worries that could hinder the performance of many ASX 200 stocks.

But, according to John Neal, Lloyd's of London CEO, don't add insurance stocks to that list.

"It's a great time to be an insurer, because if we live in a world that's riskier and more uncertain, then insurance comes to the fore," Neal said.

"Rather than the insurance being an expense, it suddenly becomes a way to protect your revenue, your profit and loss statement, your balance sheet."

Adding to global uncertainty in the year ahead is a surge of national elections set to be held in some of the world's leading economies, including what could be a turbulent election in the United States.

But again, this could benefit IAG shares and insurance stocks more broadly.

According to Neal:

Even on a simple level, just changing governments brings an added query as to what it means from a risk point of view. I think at a corporate level, people are beginning to understand the intangible value of the balance sheet.

But how about the impact of sticky inflation and potentially higher interest rates?

Inflation and interest rates

For some insight into how IAG shares have performed in a year of rising interest rates and stubbornly high inflation, we turn to the insurer's FY 2023 results, reported on 21 August.

Among the highlights, IAG reported an 8.2% year on year increase in revenue to $19.85 billion. Net profit after tax (NPAT) leapt 139.8% to $832 million. Profits surged despite a 20% increase in total claims paid, which hit around $10.2 billion over the financial year.

IAG managed to deliver this strong performance in part due to some sizeable increases in its insurance premiums.

As Motley Fool analyst Tony Yoo pointed out, "As an essential service, insurance providers have been able to raise premiums this year in line with inflation without worrying too much about losing customers."

As for higher interest rates that tend to crimp the performance of many ASX 200 companies (especially those holding debt), higher rates tend to benefit insurance companies as they get higher returns from the premiums they invest.

That was demonstrated in IAG's FY 2023 results, with management reporting a 9.6% credit margin, up from 7.4% in FY 2022.

As for what may lie ahead for IAG shares, Wilsons analyst Greg Burke said:

IAG is poised to deliver the strongest earnings per share (EPS) growth over the next 3 to 5 years out of the ASX listed general insurers, with risks skewed to the upside (vs consensus), in our view.

Potential headwinds for IAG shares

While the broader picture looks strong for IAG shares, investors should always run their slide rules over any potential upcoming headwinds.

In the case of this ASX 200 insurer, downside risks could stem from ongoing legal claims currently in front of the Federal Court. The claims, totalling some $7 billion, relate to credit insurance coverage written by Bond & Credit Company for then client Greensill Capital.

IAG held a 50% interest in Bond & Credit Company until April 2019.

Greensill Capital has since collapsed.

IAG denies responsibility for the claims and is defending itself in court.

In some potential added headwinds for IAG shares, however, yesterday The Australian Financial Review reported that White Oak, already a plaintiff in the case, intends to file new legal claims relating to Greensill Capital's insurance policies.

The outcome remains to be seen.