The JB Hi-Fi Limited (ASX: JBH) share price is down after the ASX retail share revealed how it performed in the first three months of FY24.

JB Hi-Fi revealed these numbers at its annual general meeting (AGM) for shareholders.

Mixed performance to the start of the new financial year

This update is for the three months ending 30 September 2023.

It reported a year over year total sales decline for JB HI-FI Australia of 0.1%, with a comparable sales decline of 1.4%. Compared to pre-COVID FY19, total sales had grown by 40.5%.

JB HI-FI New Zealand total sales were up 1% year over year, with a comparable sales decline of 1%. Compared to pre-COVID, total sales had grown by 22.2%.

The Good Guys total sales were down 12.2% year over year, with a comparable sales decline of 12.2%. Compared to pre-COVID, total sales had grown by 21.1%.

Commenting on the sales performance, JB Hi-Fi said that the FY24 first-quarter sales were "in line" with the company's expectations because it was cycling against the "elevated period" from last year. It also said that while total sales continue to be "well above" FY19, it's seeing variability in category performance.

Focus areas for FY24

There are five areas of focus for the company this financial year.

First is that in a tougher retail trading environment, its "strong retail execution is vital". It wants to grow its market share by attracting new customers to its brands and offering best-in-market value with offers and promotions. It'll look to leverage efficiencies in its operating model and low-cost culture to respond to the changes in the environment.

The second focus is its multichannel offering, reaching customers through online and in-store channels. It wants to give customers the best experience it can.

The third focus is 'New Zealand', with the company acknowledging that it's underrepresented in the country and this is a good opportunity to grow there. It is steadily opening stores and wants to open three to five new stores per year over the next three years. It's also 're-platforming' its New Zealand website.

Fourth, it's going to continue developing its commercial businesses for future growth, targeting the small and medium-sized business sectors. The company noted it has a national proposition in a fragmented market.

Finally, it's going to keep investing in its supply chain that supports its in-store and online fulfilment, and delivers "better customer offers and experiences." For example, a recent initiative includes improved delivery options for The Good Guys customers.

As JB Hi-Fi's CEO Terry Smart finished his AGM address, he concluded:

With the heightened uncertainty in the retail environment, our brands remain well-positioned to leverage their low-price market position as shoppers look to maximise value from their purchases. As we have continued to demonstrate, we will adapt and respond to the changing retail conditions to ensure we remain the number one destination for shoppers and grow our market share.

JB Hi-Fi share price snapshot

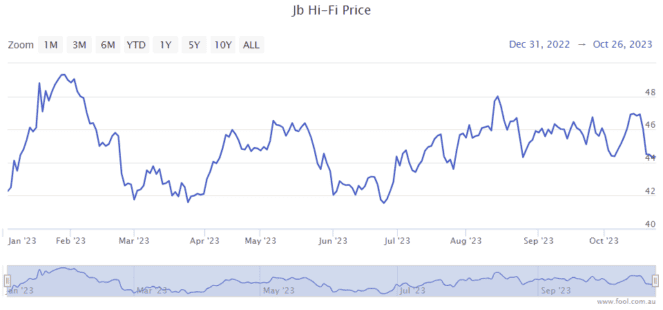

The JB Hi-Fi share price has risen around 4% since the start of the year, as can be seen on the chart below.