Downturns can be a great time to invest in cheap ASX shares because of the great value that can be found.

Investors can choose to invest at any point during the economic cycle. Sometimes there are positive bull markets and sometimes there are worrisome bear markets.

It's easy to feel confident about investing when markets are going up. But it can seem scary to invest in cheap ASX shares when the markets are falling.

However, I believe that investing in a downturn is one of the best ways to accelerate wealth-building.

Exciting time to invest

Warren Buffett is one of the world's greatest investors in my mind, and he has given some very useful pieces of advice to investors. This is one of my favourites:

To refer to a personal taste of mine, I'm going to buy hamburgers the rest of my life. When hamburgers go down in price, we sing the 'Hallelujah Chorus' in the Buffett household. When hamburgers go up in price, we weep. For most people, it's the same with everything in life they will be buying — except stocks. When stocks go down and you can get more for your money, people don't like them anymore.

Long-term investing is a better strategy than short-term investing in my opinion. But (short-term dips/crashes) of the market can provide some amazing prices to buy cheap ASX shares.

Imagine there's a business where the share price falls from $100 to $50 – a fall of 50%. If someone invests at $50 and the stock recovers back to $100 then that's a return of 100%. Sometimes the recovery can happen in a relatively quick time, like we saw after the COVID-19 crash in 2020 and after the declines seen during 2022.

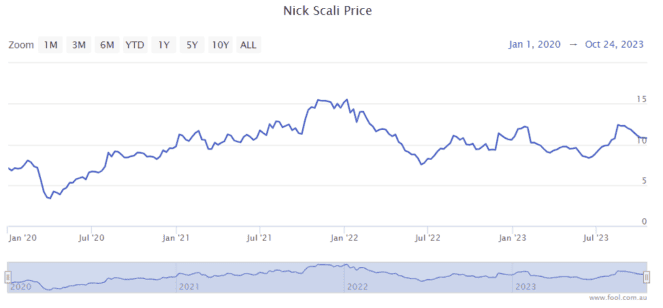

One of the companies that I think is a good example of this is Nick Scali Limited (ASX: NCK), the furniture retailer. There have been a few times where it has fallen over 30% from an earlier peak and then gone on to rise 40%, 50% or more. Past performance is definitely not a guarantee of future performance here, but it shows that a recovery from large declines can lead to good returns with the right business.

Be brave

The share market doesn't fall for a sustained period unless there is a serious issue. A collapse of the US financial system during the GFC, a global pandemic, and the world's strongest inflation for decades were all causes of market declines. Who would want to invest during something like that?

I believe the best prices can be found during downturns because that's when we'll see cheap ASX shares at valuations that are too good to ignore.

Great investing can feel uncomfortable.

Is this a great time to invest?

I think we can always find an opportunity on the ASX share market. But at the moment, I'm seeing a lot more opportunities and the prices are more attractive than they were a few weeks or months ago.

There are some areas of the market that could seem very cheap, particularly if in three years (or less) they recover some (or all) of the lost ground.

If I were to pick just two cheap ASX shares that have fallen very heavily this year that could deliver good returns over the next three years, it would be ASX retail share Adairs Ltd (ASX: ADH) and agribusiness Elders Ltd (ASX: ELD). They are both down more than 40% this year and even further from their peaks within the last two years. There are other names I'd buy first though, which I've covered in other articles.

I don't believe that the retail outlook will always seem as uncertain as it does now. Adairs is doing work on improving its long-term profitability with new stores, larger stores, changes with its national distribution centre and so on.

The outlook is worsening for Elders as well, but agriculture is usually a very cyclical industry. I believe it will recover again, as it has in the past when weather conditions improved. Elders is a bigger, stronger business than it was a few years ago during the last agricultural downturn.

While I haven't committed to investing in either of these names, I am thinking about both of them for my portfolio.