Mineral Resources Ltd (ASX: MIN) shares are 4.3% higher on Wednesday afternoon after the ASX 200 mining giant released its quarterly mining activities update.

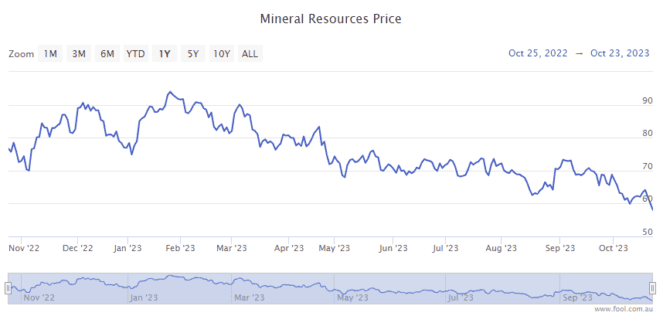

The Mineral Resources share price is rebounding from the 52-week low of $56.20 recorded on Monday.

Mineral Resource shares are currently trading for $59.92.

Let's take a look at the ASX 200 miner's report.

Mineral Resources shares rebounding from 52-week low

Today's report covers the three-month period to 30 September.

Here are the highlights for the quarter:

- Total mining production of 66Mt, up 14% on the June quarter

- Iron ore production of 4.8M wet metric tonne (wmt), up 8%. The average realised iron ore price was US$99 per dry metric tonne (dmt), representing an 87% realisation of the Platts 62% IODEX

- Ore production at the Mt Marion lithium operation of 807 dmt, up 31% as stripping of new areas continued to open multiple mining fronts. Spodumene concentrate production of 64 dmt, up 7%

- Ore production at the Wodgina lithium operation of 1,044 dmt, up 45% following Stage 1 pit advancement, which allowed access to fresh ore. Record spodumene concentrate production of 45 dmt, up 10%

- Wodgina lithium battery chemical production of 4.8kt, up 14%, and sales of 4.3kt, up 11%. The average realised lithium battery chemical revenue was US$34,036 per tonne (excluding VAT), down 16%

What else is news at MinRes?

Last week Mineral Resources announced the successful restructuring of its MARBL joint venture with Albemarle Corporation (NYSE: ALB).

This deal will see Mineral Resources' ownership of Wodgina lift from 40% to 50%, while Albemarle will take full ownership of the Kemerton Lithium Hydroxide Plant.

Mineral Resources expects to receive payment of between US$380 million and US$400 million for its share of Kemerton by December.